Apple shares are up more than 4% this morning in early trading as the firm beat revenue and earnings estimates last night. Apple also raised projections for their fourth quarter. Apple’s better than expected results came on the back of higher average selling prices for the iPhone.

Is that good news?

It could be if you believe the higher price for the 10-year anniversary model is sustainable. We aren’t so sure. Pricing power tends to be illusive in the consumer electronics space.

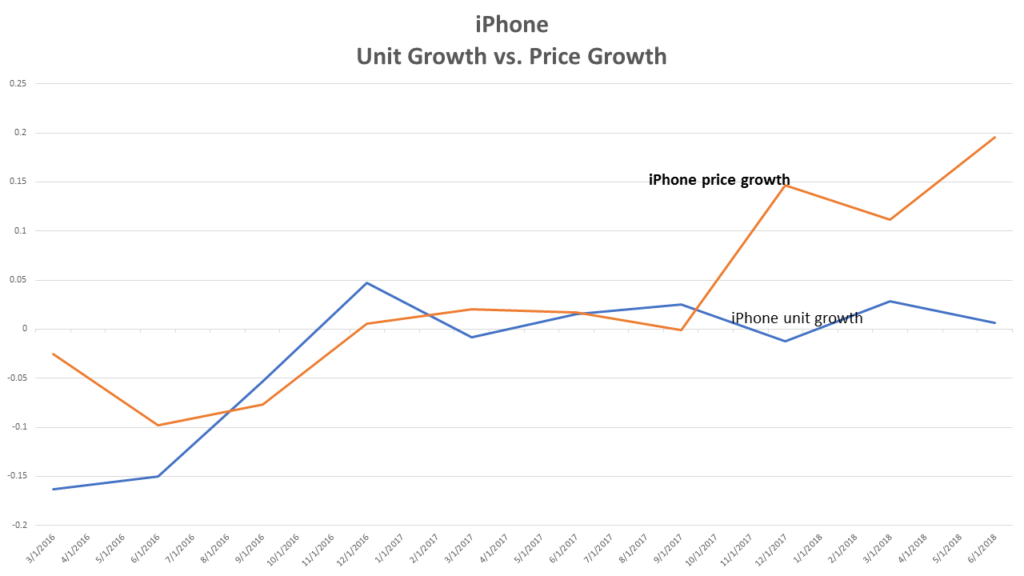

The chart below is perhaps the single most important chart for Apple investors. What you are looking at is iPhone unit sales growth vs. iPhone price growth. Apple is basically the iPhone. The iPhone accounts for over 60% of revenue. Add in all of the ancillary services tied to the phone and the number is probably closer to 80%.

The chart shows prices are booming, but unit growth flat-lined in 2016. That could be trouble over the next five years.