President Trump is looking for deeper concessions from China before he rolls back existing tariffs and cancels scheduled new tariffs. David Lawder reports for Reuters:

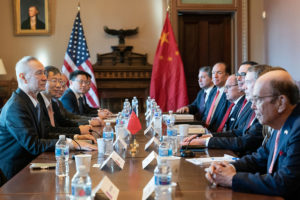

A “phase one” trade deal between the United States and China was supposed to be a limited agreement that would allow leaders from both countries to claim an easy victory while soothing financial markets.

But it may morph into something bigger if U.S. President Donald Trump agrees to Beijing’s demands to roll back existing tariffs on Chinese goods, people familiar with the talks say.

China’s commerce ministry said this month that removing tariffs imposed during the trade war is an important condition to any deal. The demand has U.S. officials wondering if higher Chinese purchases of U.S. farm goods, promises of improved access to China’s financial services industry, and pledges to protect intellectual property are enough to ask in return.

Two people briefed on the talks said Trump has decided that rolling back existing tariffs, in addition to canceling a scheduled Dec. 15 imposition of tariffs on some $156 billion in Chinese consumer goods, requires deeper concessions from China.

“The president wants the option of having a bigger deal with China. Bigger than just the little deal” announced in October, said Derek Scissors, a China scholar with the American Enterprise Institute in Washington.

Scissors, who consults with administration officials, said whether Trump will agree to remove existing tariffs depends largely on whether he believes it will benefit his re-election chances. Some White House advisers would like to see China agree to large, specific agricultural purchases, while the U.S. maintains existing tariffs for future leverage.

Read more here.