Meet the stock market: he’s a valuable economic indicator, but he also has a tendency to lie—even compulsively. The stock market misdirects, misleads, and misinforms. The only time to rely on the stock market is when he is accompanied by his more honest older brother. The stock market’s older brother will let you know if his devious younger sibling is telling you the truth or feeding you a tall tale. Who is the stock market’s more trustworthy older brother? The bond market.

The bond market keeps his younger brother in line. If the stock market signals that the economy is getting better by hitting new highs, you’d better check the action in the bond market before drawing any conclusions. If bond yields aren’t rising in tandem with stock prices, something could be amiss.

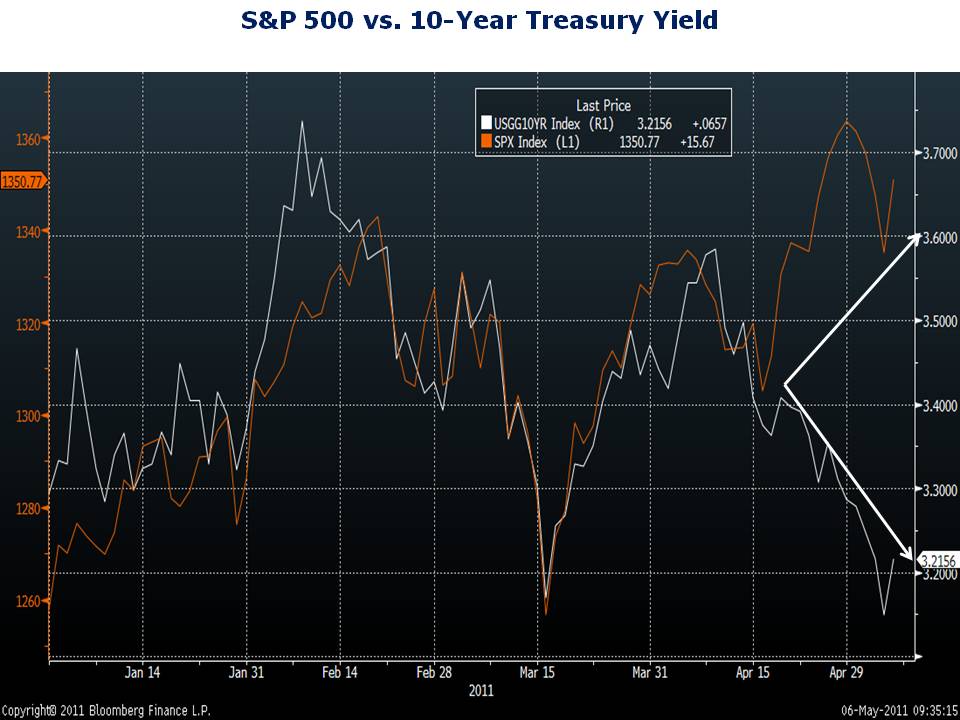

Up until this week, there was a divergence emerging between stock prices and bond yields. While stocks were reaching new 52-week highs, bond yields were falling. Check out the YTD rhythm of the stock and bond markets in my chart. The 10-year Treasury rate is in white. The S&P 500 is in orange. Stock prices and bond yields tracked each other closely until mid-April. In mid-April, the stock market advanced to a new high, but bond yields trended down. The bond market was signaling that his younger brother was misleading us.

What is the bond market concerned about? It could be the breakdown in the Citigroup Economic Surprise Index. My chart shows that the Economic Surprise Index has plunged since peaking in March. Economic data are coming in softer than many economists were anticipating earlier in the year. It could be that gasoline prices are having a bigger impact on consumers than was believed or that the double dip in the housing market is hurting the economy. Whatever the cause, the bond market is signaling caution. Remain skeptical of the strength in stocks until and unless bond yields start moving back up.