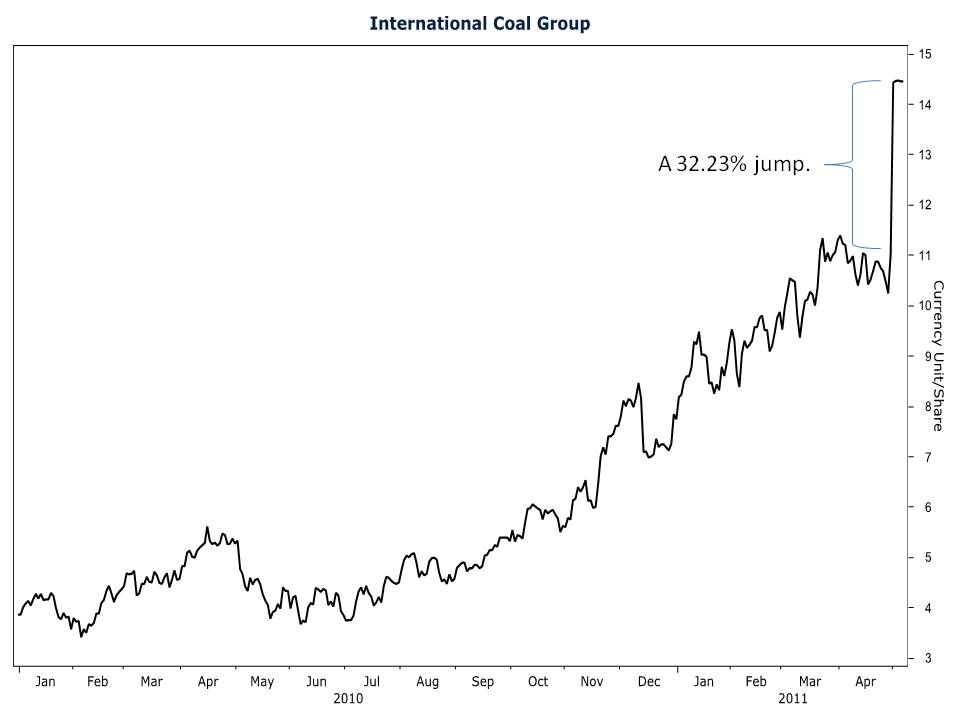

Over the past year U.S. exports of metallurgical coal (met-coal) have nearly doubled in dollar terms. Increased trade of metallurgical coal, used in the steelmaking process, has led to consolidation in the coal mining industry as major players scale-up to meet the demands of globalized competition. Toward that end, Arch Coal (NYSE:ACI) announced a deal to buy International Coal Group (NYSE:ICO) on May 2, pushing ICO’s price up 32.23% last week, making it this week’s Market Mover.

Arch Coal’s management estimates that world steel consumption will increase by 60% over the next decade, and met-coal is used in almost 70% of global steel production. The obvious takeaway from the projection is a major increase in demand for metallurgical coal in the days ahead. After the acquisition is completed, Arch Coal will be the second largest producer of metallurgical coal in the United States, and the ninth largest in the world.

While adding the met-coal capacity to its business is the bread and butter of the acquisition, Arch Coal will also be the world’s fourth largest producer of coal, including the cheaper thermal coal used to generate electricity. And though the pace of new additions to coal fired electricity generation may be sluggish in the U.S., there are 425GW of new generating capacity planned worldwide. Today in India and China alone there are 180GWs of capacity under construction. While natural gas may have transformed the energy picture in the U.S., the world is still powered by coal.