Is this becoming a tradition? I am of course talking about Wall Street’s calls for the Federal Reserve to fire up the free money truck. It was this time last year at the Fed’s annual Jackson Hole symposium that Chairman Bernanke first signaled QE2 was on the way. Now as then, Wall Street is demanding that Mr. Bernanke signal another round of money printing during his keynote speech.

The Street has read in Mr. Bernanke’s playbook that for years now, the Fed has been targeting stock prices. Anytime the Dow tumbles, the Fed eases monetary policy. Just look at its latest action to prop up the market.

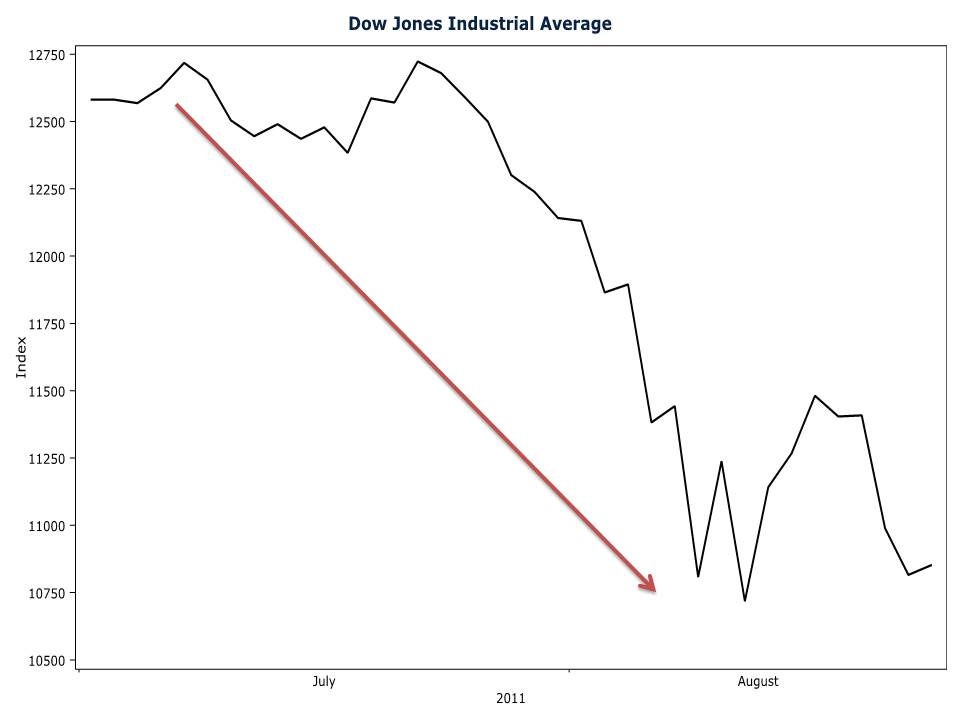

Only a few weeks ago, Mr. Bernanke thought that economic growth was going to pick up in the second half of the year. But at the FOMC’s August meeting, the chairman announced that the Fed would hold interest rates at zero for another two years. What had changed in only a few weeks? The Dow fell more than 15% from late July to early August. Bernanke panicked. He still clings to the belief that propping up the stock market stimulates the economy.

Clearly it does not. In the first half of this year with the Fed printing billions of dollars each week to prop up stock prices, GDP growth slowed to a mere 0.8%. Printing money doesn’t lead to sustainable growth. But that won’t stop the Wall Street crowd from demanding another liquidity injection from the Fed. When Mr. Bernanke fires up the money printing presses, stock prices rise and Wall Street bonuses go up. And that won’t stop Mr. Bernanke from moving forward with another dose of misguided monetary stimulus.

According to Barclays Capital, investors are already discounting another $500–$600 billion in quantitative easing. You can see the anticipation of more quantitative easing in the equity markets today. Economic data released this morning came in below expectations, but instead of falling, stock prices are up more than 3.5%. Traders and speculators are anticipating that the weaker economic data make QE3 more likely. If Mr. Bernanke doesn’t give into the Street’s demands, stock prices could tumble—just the opposite of what Mr. Bernanke wishes.

Wall Street is counting on a QE3 (or something like it) announcement from Mr. Bernanke. The only question is when: this week in Jackson Hole or after a bigger drop in the Dow.