In 2010, Larry Ellison paid $10.5 million for the Astors’ Beechwood mansion on Bellevue Ave in Newport, RI not far from my office. And based on all of the heavy duty staging, Ford F-150s, and workers (that I can see) $10.5 mil is simply the price for admission. Larry’s going deep on this one. Meanwhile, homes in Newport have a median price of $421,000 according to Trulia.com. Who needs the Fed? Newport and other desirable markets like Manhattan are fine without the Fed. That raises the question; how much has the Fed really helped less desirable markets with all of its money printing?

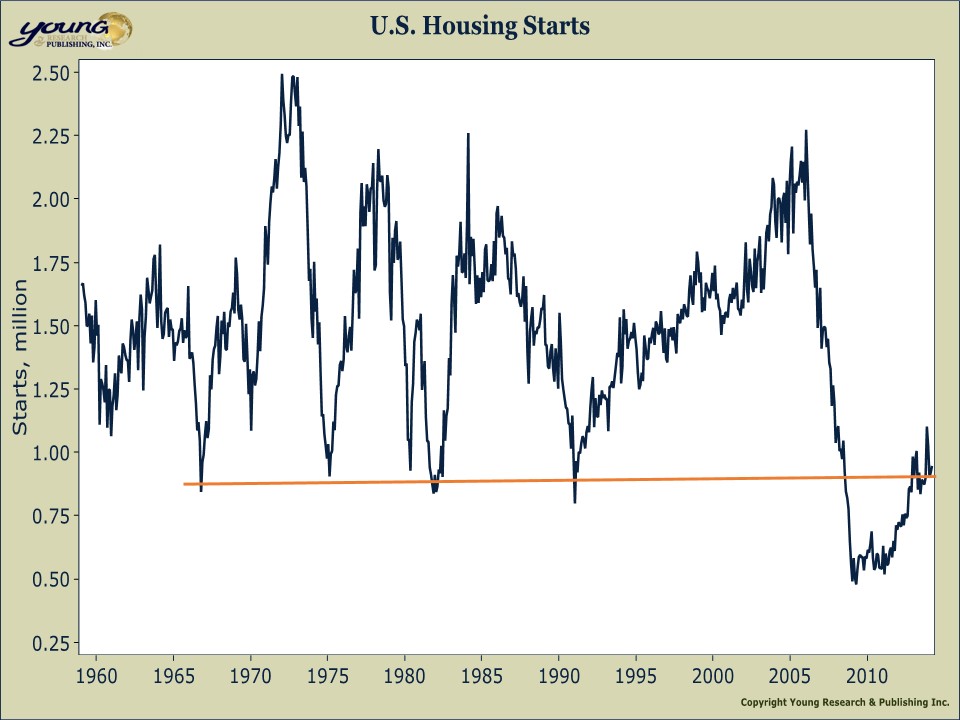

The answer: Not much. With the trillions of dollars the Fed has created out of thin air, the real estate market is basically on life-support. Take a look at the 1959-current numbers for U.S. Housing Starts. Only now are housing starts reaching levels where they normally bottom out during a recession.

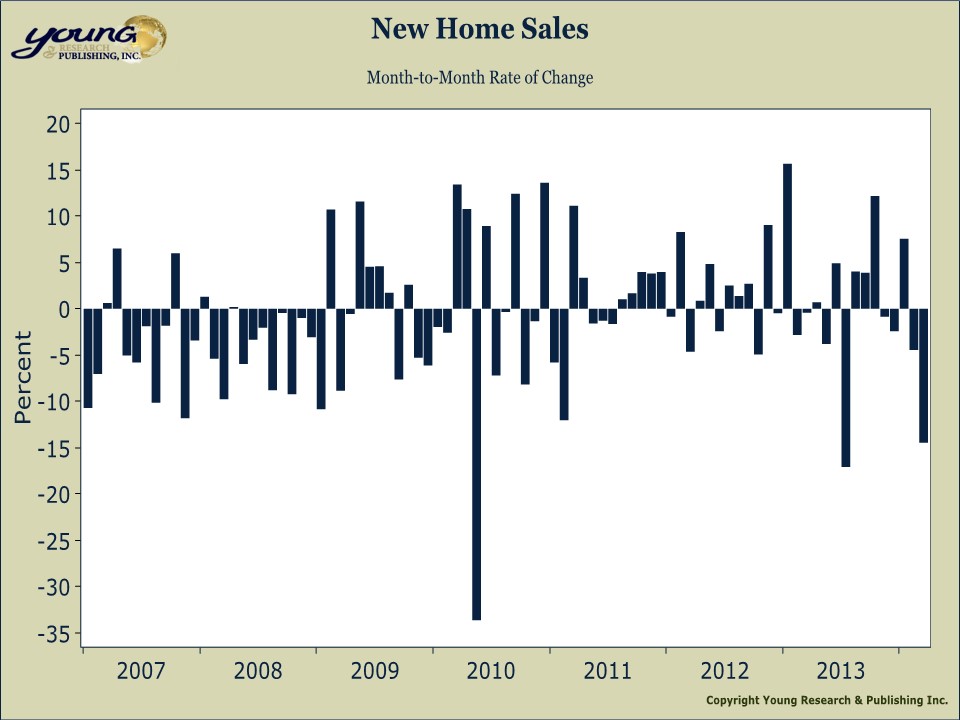

U.S. New Homes Sales look like the rocky edges of Brenton reef off Newport’s Ocean Drive. The negative 14.5 percent wreckage in March adds insult to injury. And real estate execs want lower prices. “We’d like to try to bring our [average selling prices] down across the country,” said Meritage Homes Corp Chief Executive Steven Hilton in a conference call. “They’re getting relatively high. I don’t see anything on the horizon that gives me a lot of excitement that the first-time buyer is coming back.”

And the last four out of five months have been terrible.

We’ve seen this play out for a while now. “Yes, there has been a measurable improvement, but a certain softness continues to prevail despite record setting injections of liquidity by the Fed. So are you impressed? You shouldn’t be. The little guy is tapped out, living on a debit card and maybe sans a job. Mortgages are still under water. Small business owners are justifiably reluctant to hire, and Americans, in general, are in a pretty foul mood…” wrote Dick Young in the October issue of Intelligence Report. To add insult to injury we have a new Fed Chariwoman, Janet Yellen chomping at the bit to prove herself worthy of the lofty title. She is hammering home a misguided Fed policy that was wrong from the very beginning going back to Greenspan and then Bernanke. This cannot end well.