You know something’s amiss when the Fed pumps $85 billion a month into the system. The Fed’s balance sheet has ballooned to $3.85 trillion. What’s missed by the media is that 60% of the Fed’s balance sheet is excess reserves or $2.3 trillion—money that banks keep on deposit at the Fed. Banks currently earn 0.25% from the Fed, which is actually paid by you and me the taxpayer. This is simply a ripple now, but wait until interest rates go up. The cost to taxpayers could be catastrophic. “A return to even a normal 2% rate on excess reserves of $2.3 trillion would cost U.S. taxpayers $46 billion. As former New York Fed legal officer Walker Todd—who authored a May paper titled ‘The Problem of Excess Reserves, Then and Now’—pointed out to me this week, if we hit a period similar to 1994-1995 when the Fed funds rate increased by 3.25 percentage points over one year, the cost of containing $2.3 trillion in excess reserves would reach $80 billion annually,” writes Mary Anastasia O’Grady of The Wall Street Journal.

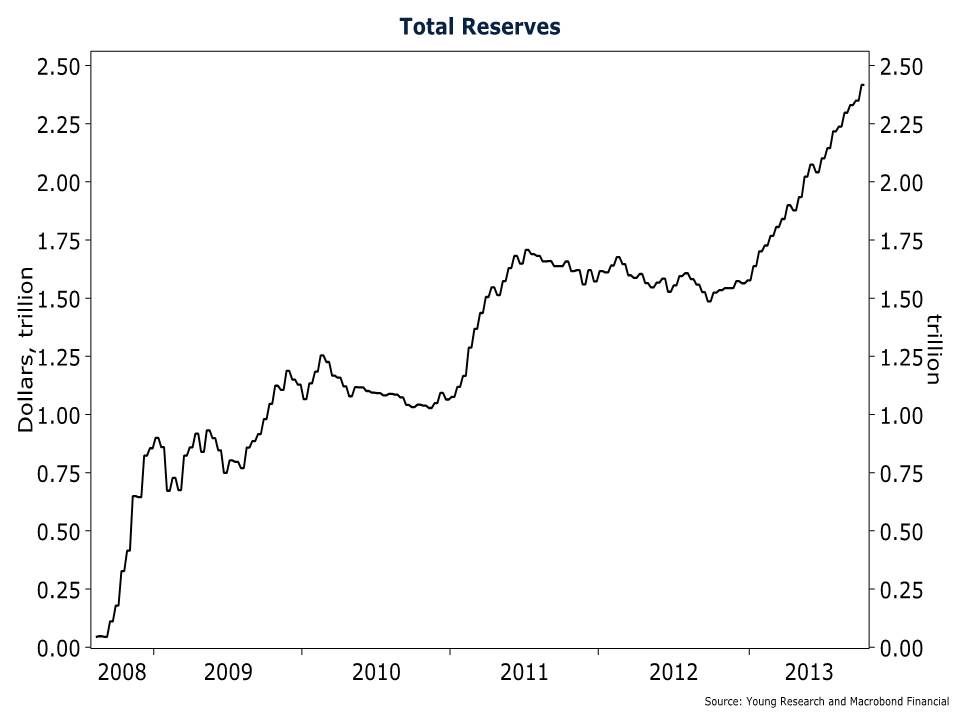

Take a look here at the skyrocketing quantity of total reserves, made up mostly of excess reserves.

E.J. Smith works with new investors that have $2 million or more to invest. He can be reached at:ejsmith@youngresearch.com.