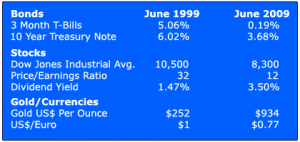

Have you looked at interest rates lately? 3-month T-Bills are at 0.20%, 3-month CDs 0.38%, money markets 1.29%, 5 year CDs 2.62% and 10-year Treasury bonds are at 3.68%. Compare this to the near peak of the tech bubble ten years ago when the 10-year Treasury was at 6.02%. $1 million in a 10-year Treasury Note paid $60,000 annually. Today it pays $37,000 or 40% less.

In retirement your ability to understand income and values are paramount to your investment success. Thinking in terms of 10 year periods allows your portfolio time to breath. And in terms of values, think about each asset class being in competition with each other trying to win your investment money.

To help you understand values, I’ll compare the landscape today to 10 years ago when the U.S. government was running a budget surplus and the Euro was first introduced as a currency. The purpose of this exercise is to gain perspective and not to rub investors’ noses in the dirt.

In 1999, the 10-year Treasury Note yield was 6.02%. To compare this with stocks you can do a back-of-an-envelope calculation taking the inverse of the stock market P/E. The inverse of the P/E is 1/32, or an earnings yield of 3.12%. So clearly in 1999 the 10-year Treasury Note of 6.02% offered value over stocks with an earnings yield of only 3.12%.

Today the 10-year Treasury Note yields 3.68% and the earnings yield on the stock market is 8.3%, the inverse of a P/E of 12. Obviously, stocks currently offer more value than Treasuries. The 3.5% stock market dividend yield alone is almost comparable to the 10-year Treasury Note. Income investors need to have some money in stocks today.

I know many investors are in cash today wringing their hands over these low yields. With a reflationary Fed, the probability of US$ weakness is notable. Consider how the U.S. dollar faired against the Euro over the past 10 years. A $1 million cash holding of U.S. dollars in 1999 is only worth 770,000 Euros today pre-inflation. Of course, the 370% ten-year increase in the price of gold illustrates the value eroding impact of inflation.