The Problem

Without congressional action the Bush tax cuts will expire in 2013. Expiration would lead to higher income taxes for all brackets, and lead to dividends being taxed at marginal income tax rates for middle-and upper-income filers. The potential for higher income tax rates on dividends is scaring many income investors. These investors are wondering if it is time to sell dividend stocks and buy non-dividend payers. The short answer is no.

Compromise on the Way

The President is pushing to keep income tax rates the same for all but the top tax bracket, and pushing to keep dividend rates the same for married filers that report adjusted gross income of less than $250,000 ($200,000 for individuals). Meanwhile, Republicans are pushing to maintain the existing rate structure. There is support on both sides of the aisle for dividend tax rates lower than those of the Clinton era. It’s only a matter of time before a dividend tax compromise is worked out.

Long History of Outperformance

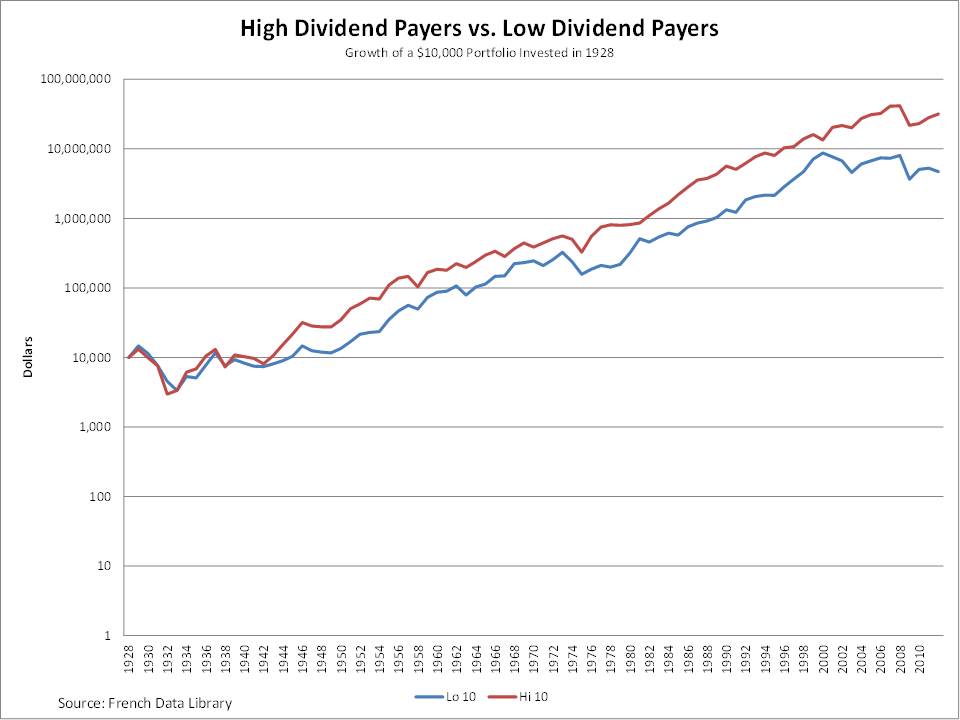

The truth is that even when dividends are taxed at marginal income levels, high dividend stocks still have appeal. The chart below compares a portfolio of the highest yielding (top 10 percent) stocks to the lowest yielding (bottom 10 percent). High dividend payers are the clear winner in the long-run. The high dividend portfolio has been more valuable than the low dividend portfolio since 1938. Today, the high dividend portfolio is worth 572.6% more than the low dividend paying portfolio.