If you know how compound interest works, you’re in good company. Einstein referred to it as the eighth wonder of the world. Compound anything at 10% for 60 years and you have 300 times more than what you started with. Do that with your money and you’re a genius.

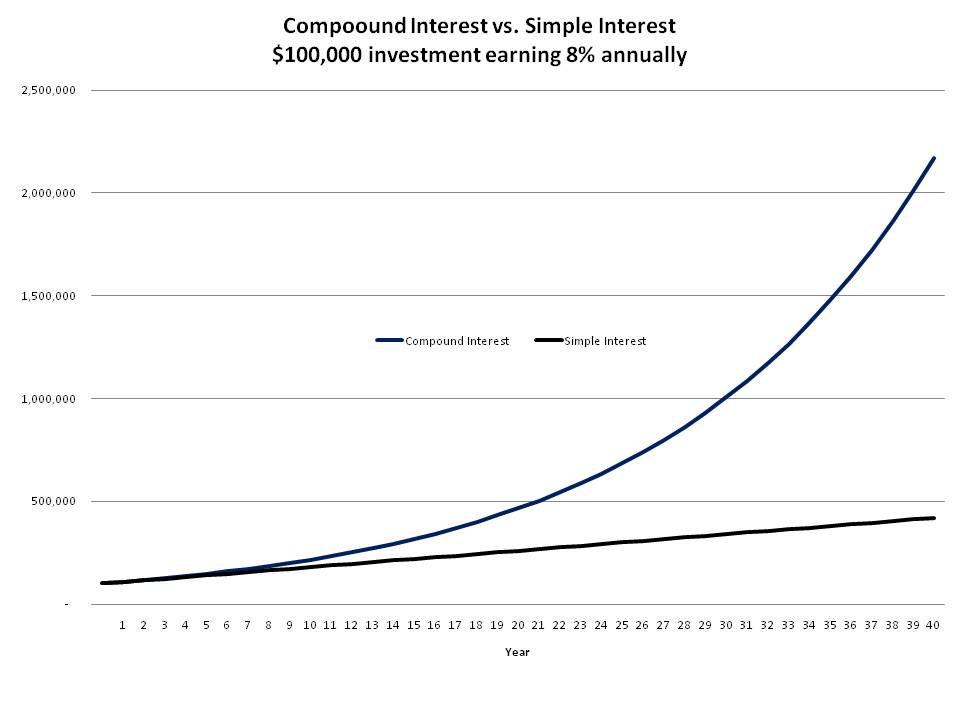

Time and money are the key ingredients in this magical formula. Unfortunately, you usually don’t have money when you’re young, and you have less time when you’re older. Compounding for 20 years—a long time, no doubt—at 10% gives you just over 6X your money. But it’s not until years 40 (45X at 10%) and 50 (117X at 10%) when compounding really kicks in—and I mean big-time.

You could give this gift that keeps on giving to a grandchild. If you’ve got the money, they’ve got the time. An irrevocable trust where the money compounds untouched for 40 to 60 years would do the trick. Buy the Vanguard Wellington fund or the Vanguard Wellesley fund.

The Vanguard Wellington fund, from its inception on July 1, 1929, has returned 8.29% a year. Not quite 10%. But compounding 8% over 80 years turns $10,000 into $4.7 million. The Vanguard Wellesley fund, from its inception on July 1, 1970, has returned 10.19% a year. Compounding 10% over 40 years turns $10,000 into $452,000.

I think Einstein would agree that’s not a bad way to think about accumulating wealth for your family.