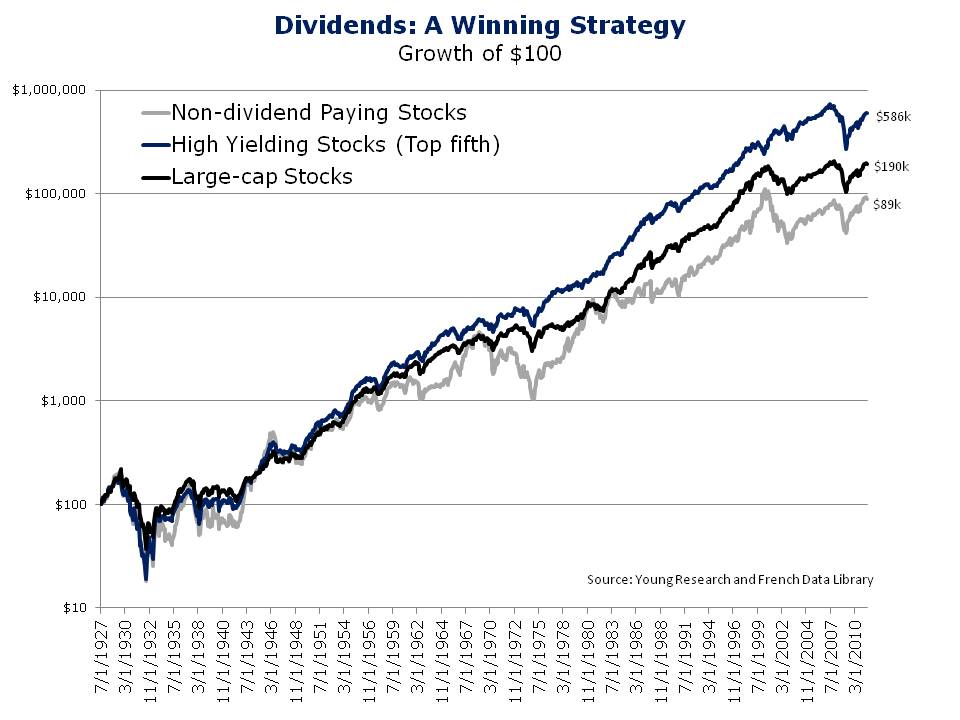

Over more than eight decades of stock market history, a dividend focused approach has been a winning investment strategy. Consider that if you invested $100 in the stock market in 1927—as measured here by a portfolio of large-capitalization stocks— today your portfolio would be worth $190,000. A tidy sum to be sure, but if you instead invested that same $100 in the highest yielding stocks (top 20%) and rebalanced annually, your portfolio would now be worth $586,000. That’s three times as much.

To some, a dividend-focused approach just sounds too boring. The highest yielding stocks are often utilities and consumer products companies. These aren’t exactly dynamic growth industries. This more speculative crowd is interested only in growth. They want to find the next Microsoft or Apple. If you are tempted by such a strategy, ponder this; if in 1927 you invested $100 in non-dividend paying stocks—all the speculative hot growth companies— and rebalanced annually, your portfolio would be worth only $89,000 today. That’s less than half the return of the market. Swinging for the fences can cost you big.

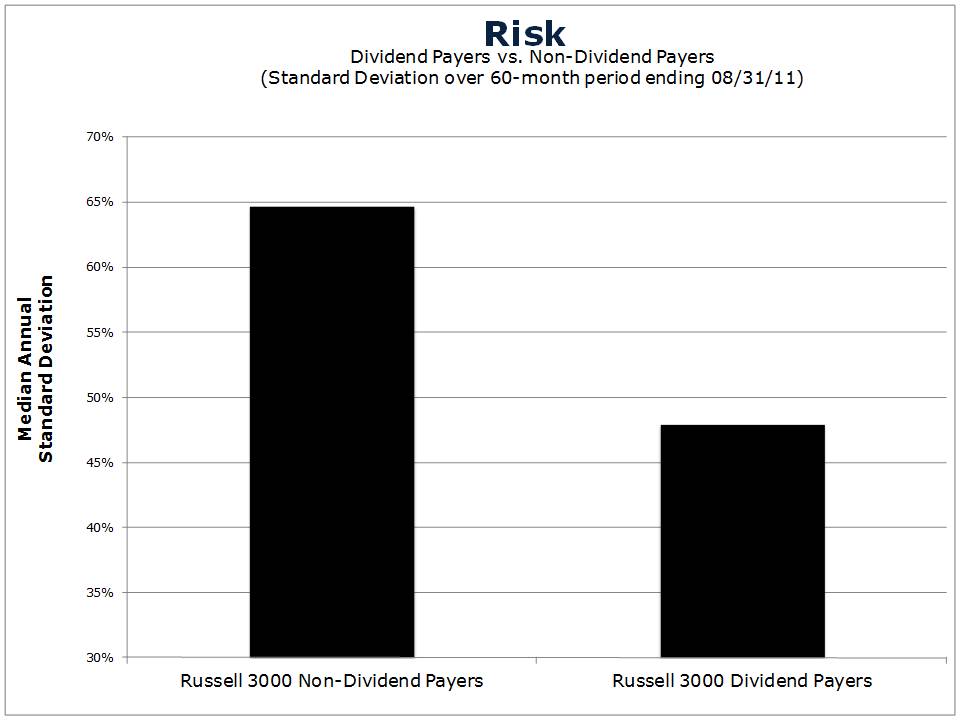

The simple recipe to becoming a more successful long-term investor is making dividends a focal point. And the best part of a high-yield strategy is that you don’t even have to take more risk to reap the rewards. My chart below shows that, on average, dividend paying stocks are less volatile than dividend payers.