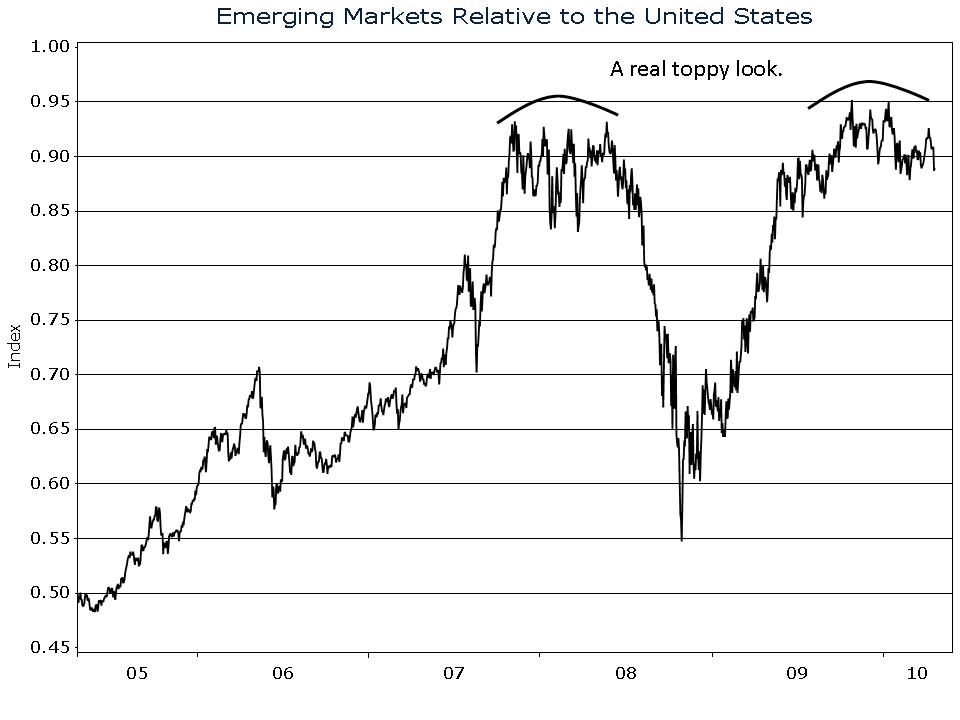

Emerging market stocks are up over 110% since hitting lows in March of last year. Net flows into foreign stock funds, much of it into emerging market funds, have been positive for 11 months in a row while U.S. stock funds have seen outflows in six of the last seven months. Those investors liquidating U.S. stocks and piling into emerging market stocks could be disappointed over coming quarters. Our relative strength chart shows that emerging market stocks have a very toppy look vs. U.S. stocks. Individual country and issue selection in emerging markets is now more important than ever.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023