Yesterday, Bloomberg reported that the U.S. Treasury sold $24 billion of 10-year notes at a record low auction yield. The bonds were sold at a yield of 1.85% which is lower than the 1.9% yield on 10-year notes sold in January. What investor would willingly lend the federal government money for ten years at a 1.85% interest rate? Aren’t these folks aware that this is the same federal government that has racked up trillion dollar deficits for three consecutive years and promises at least one more year of the same?

On a fundamental basis, long treasury bonds are one of the world’s most overvalued asset classes. After adjusting for inflation, 10-year treasuries are a guaranteed money loser. In other words, investors buying long treasuries today are paying to lend the government money. Sound like a smart investment strategy to you?

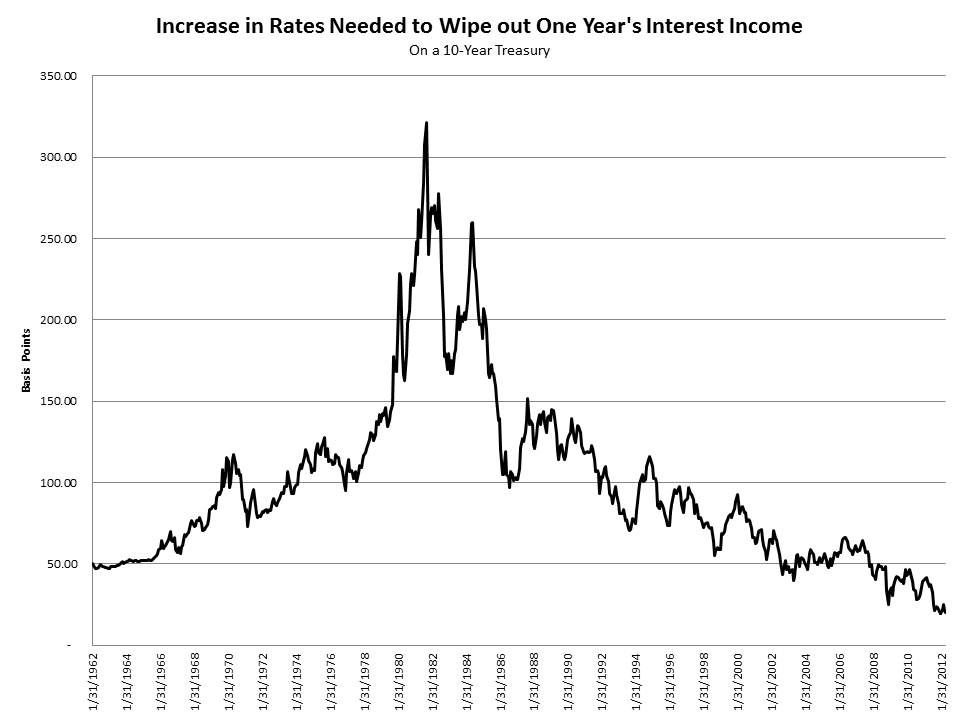

At Young Research we are avoiding long treasuries and we advise the same for you. A mere 20 basis point increase in interest rates would wipe out an entire year’s worth of income from a 10-year treasury note. And if interest rates rose by 1%, ten year treasury notes would lose the equivalent of four years of interest income. Investors reaching for yield in long bonds are setting their portfolios up for a serious maiming. Keep your bond maturities short.