You can go to a local U.S. Range Rover dealership this weekend and buy a nicely equipped Range Rover HSE for $85,000 or a Supercharged for over $100,000. If you finance it in U.S. dollars, at least you know what you owe. If you want to be as fancy as your new car, you can borrow in a foreign currency and pay it back with your local currency. You’ll be styling with the best of the hedge fund managers if your currency appreciates. But what happens if the bottom falls out?

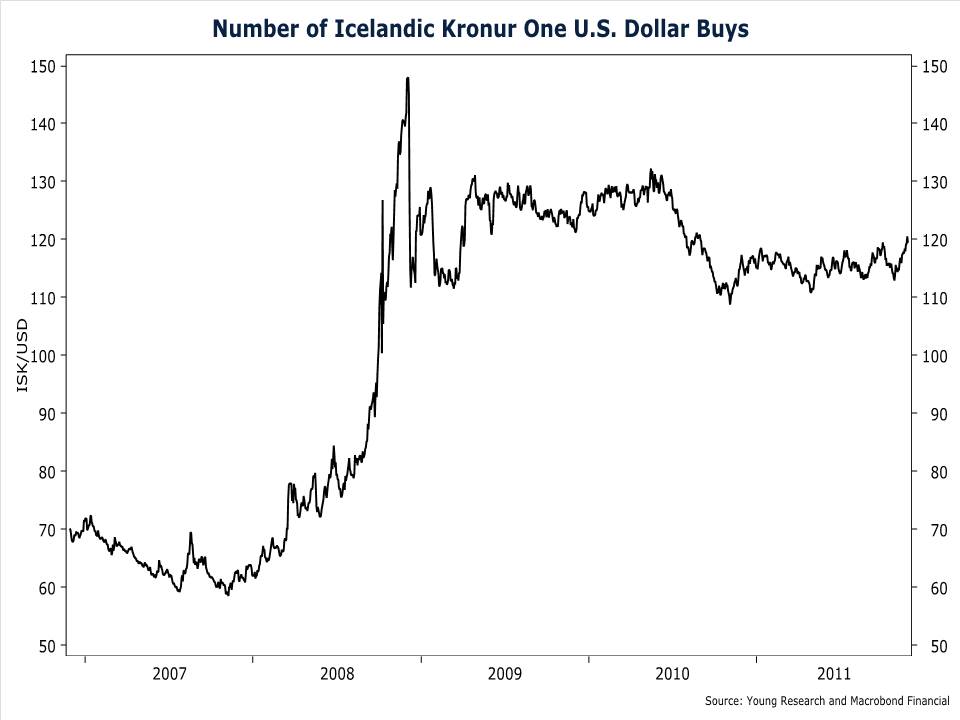

That’s exactly what happened in Iceland this decade. In his new book, Boomerang, Michael Lewis writes about what happens when a nation of fishermen turns into a nation of hedge fund managers. He explains how with their newfound expertise and with local interest rates running near 15.5% the Icelanders borrowed in yen or Swiss francs to buy Range Rovers. But when the Icelandic krona cratered, owners of Range Rovers financed at the equivalent of $35,000 suddenly owed $100,000. Visiting Iceland at the time, Lewis commented to a local about the unsettling explosions outside his hotel room. It turned out that those explosions were the solution to the Range Rover debt:

To the Range Rover problem there are two immediate solutions. One is to put it on a boat, ship it to Europe, and try to sell it for a currency that still has value. The other is set it on fire and collect the insurance: Boom!

Check out Michael Lewis’s Boomerang for some more examples of the mistreatment of money.