Can you guess which of the world’s currencies has appreciated the most this year? If you guessed the Paraguayan guarani, you’re right. A close second was the kina. Which country uses the kina? Why, Papua New Guinea, of course! If you would have trouble spotting either of these countries on a map, you aren’t alone.

Like most sane investors, you probably limit your currency investing to developed countries and some of the larger emerging markets. Which major currency has performed the best this year? The Swiss franc. Just this year, the franc has gained 11.5% on the dollar. That crushes the 1% YTD return in the S&P 500. The franc is gaining because it is a safe-haven currency. When euro-area government debt worries come to the fore, investors sell their euros and, yes, buy dollars—but they also buy francs, with much more enthusiasm. And when investors worry about unsustainable U.S. debt levels or nuclear meltdowns in Japan, they buy francs.

Why is the Swiss franc a safe-haven currency? Switzerland is a neutral country, produces more than it consumes, and has run prudent fiscal and monetary policies for decades. Contrast that with the U.S. The U.S. is the world’s self-appointed police chief. That makes friends, but also creates enemies. The U.S. runs a persistent and troubling trade deficit and profligate fiscal and monetary policies. The U.S. Congress has racked up staggering deficits without batting an eyelash, while dithering over the trillions of dollars in unfunded Medicare and Social Security obligations. As for U.S. monetary policy, it has been a disaster. The Fed provoked the inflationary spiral of the 1970s by keeping money too loose for too long. Then in the late 1990s and the 2000s it created not one, but two asset bubbles in the span of a decade, the latter of which almost took down the U.S. financial system.

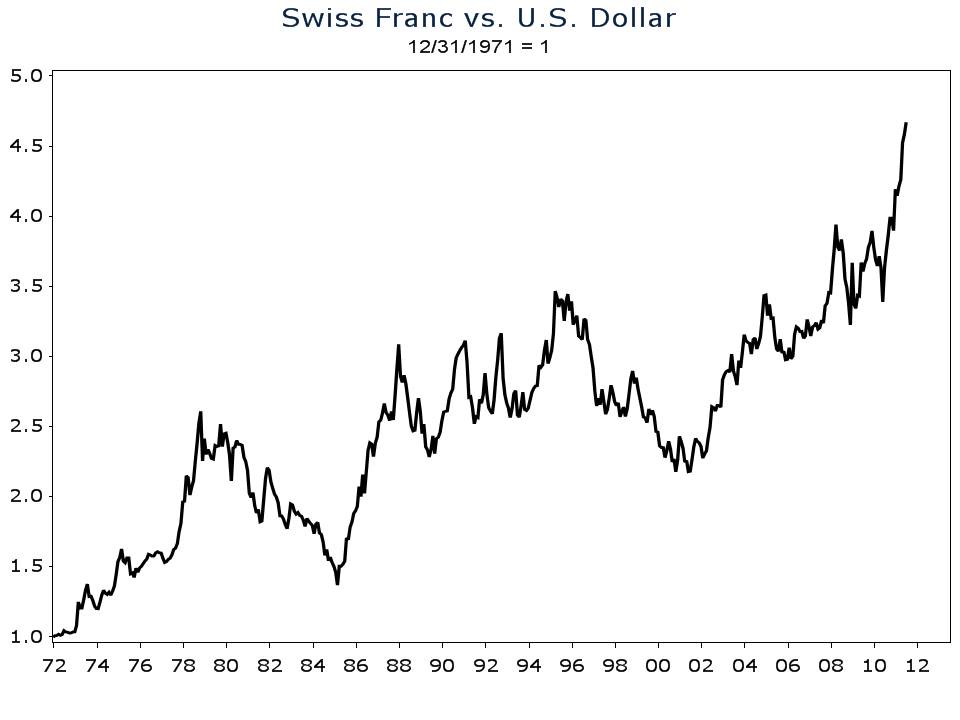

If you think I’m being unfair to the U.S., then I would advise that you take a look at the historical record. Here I am referring to the exchange rate value of the franc versus the dollar. I’ve included a chart of the franc-dollar exchange rate below. My chart shows the value of a single U.S. dollar invested in the Swiss franc at year-end 1971. What does the market say about U.S. management of the dollar? In only four decades, the franc has gained over 366% on the dollar. Said another way, the dollar has lost 80% of its value versus the Swiss franc. Point, set, and match for the Swiss.

In Young Research’s Global Investment Strategy, we advise on currencies, commodities, and global stocks and bonds. To find out which currencies we are buying today, please join us.