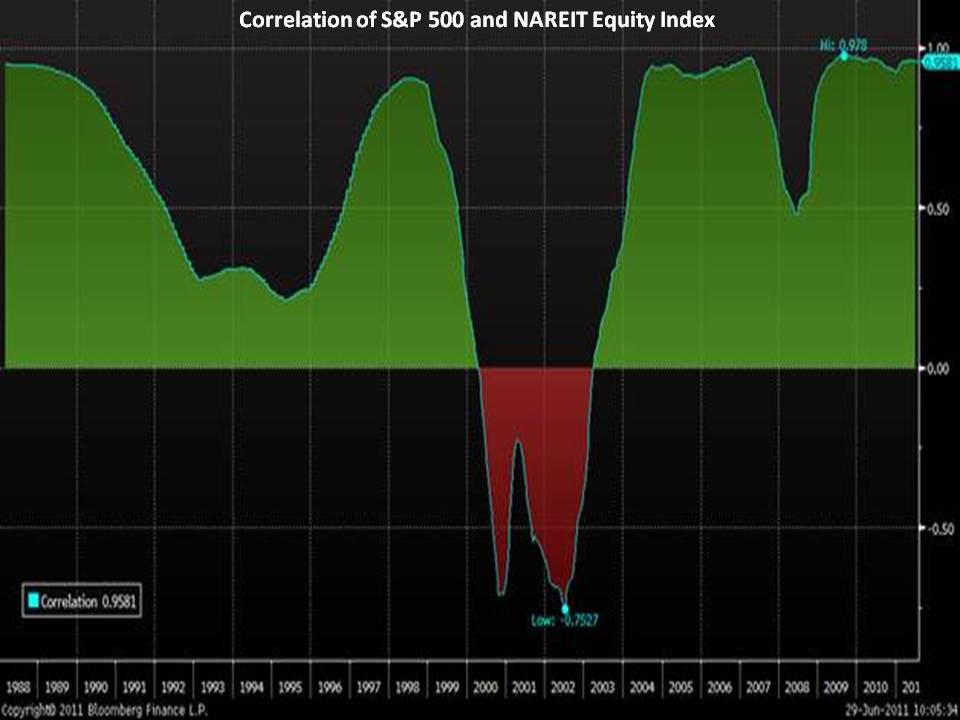

The following chart illustrates the close correlation in recent years between real estate investment trusts (REITs) and stocks. For my money, this makes REITs far less attractive today than did the negative or low correlations and the much higher yields of days gone by.

And I also don’t see much value in REITs given that 10-year Treasuries yield about the same—both are near 3% today.

In a separate item, the Securities and Exchange Commission is looking into nontraded REITS as reported in the Wall Street Journal piece “Nontraded REITs Are Put on Notice by SEC.” The article reports, “Money has poured in from individual investors drawn to the steady annual returns of about 7% despite initial fees that often are around 10%.”

The Financial Industry Regulatory Authority (FINRA)—the largest independent regulator for all securities firms doing business in the United States—has issued a complaint against a non-traded REIT offered by David Lerner Associates. Here’s an excerpt from FINRA’s news release dated May 31, 2011:

The Financial Industry Regulatory Authority (FINRA) announced today that it has filed a complaint against David Lerner & Associates, Inc. (DLA), of Syosset, NY, charging the firm with soliciting investors to purchase shares in Apple REIT Ten, a non-traded $2 billion Real Estate Investment Trust (REIT), without conducting a reasonable investigation to determine whether it was suitable for investors, and with providing misleading information on its website regarding Apple REIT Ten distributions. DLA has sold and continues to sell Apple REIT Ten targeting unsophisticated and elderly customers with unsuitable sales of the illiquid security.

You don’t hear much about their fee structure in this promo piece:

The Wall Street Journal continues, “Some critics of nontraded REITs claim unsophisticated investors don’t understand that firms often don’t generate enough cash flow from the properties, at least initially, to cover annual payments to investors. Borrowing to pay a dividend is a concern,” said Mike Kirby, a principal at Green Street Advisors, which analyzes publicly traded REITs. “You have to wonder how sustainable that business model is.” Yes, you do have to wonder.