Markets are bullish, as new highs on the NYSE, AMEX, and NASDAQ outpaced news lows by 8 to 1 last week. A total of 1,109 new highs were recorded, compared to only 137 new lows. Investors should thoroughly examine any stocks trading at new lows in this market. There are probably some hidden gems, but beware stocks of companies whose industries are structural quagmires.

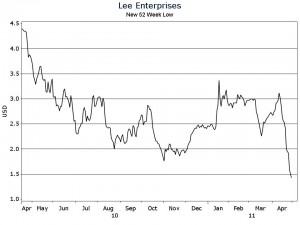

One company getting hit by a double whammy of structural changes is newspaper publisher Lee Enterprises (NYSE:LEE). The publisher owns dozens of newspapers with a total Sunday circulation of 1.65 million. Its most notable papers are the St. Louis Post Dispatch, the Arizona Daily Star and the Wisconsin State Journal. The internet has put newspaper publishers on their heels, and Lee Enterprises is no exception. In the last quarter LEE increased online advertising revenue by 26.3%, but that wasn’t nearly enough to stem a total revenue decline of 3.8%.

You see, LEE isn’t just facing a difficult shift in consumer behavior (i.e. reading news online), it is also facing a shift in consumers themselves. Lee Enterprises core markets are in the Midwest “rust belt” states like Illinois and Wisconsin. Demographic trends are not very strong for most of LEE’s papers.

If you’re bottom fishing on the New Lows list, be sure to perform the proper due diligence. While there are trophies on the list, randomly buying new lows could find you snagging your line in the weeds.