Adrienne Roberts and Mike Colias write in the Wall Street Journal that automakers are hoping a surge of summer buying will save their bottom lines from what appears to be a rapidly cooling market for automobiles. They write:

Overall, auto makers sold 1.43 million vehicles in the U.S. in April, down 4.7% from a year earlier, according to Autodata Corp.

Detroit is hoping its traditionally strong summer sales season will get it out of the rut. Car makers plan to offer plenty of discounts, and rely on low gasoline prices and broad economic strength.

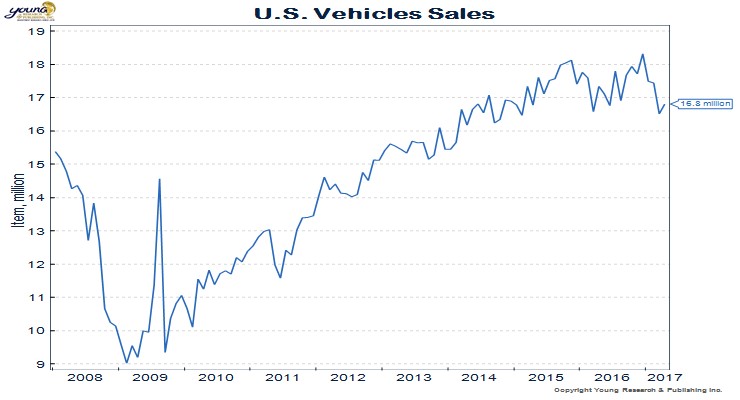

The U.S. auto industry has been on a winning streak since bailouts rescued GM and Chrysler in 2009. After seven straight years of sales gains, including two consecutive record performances, demand has cooled in 2017’s first four months despite soaring discounts.

Ford saw the biggest April sales slump, with a drop of 7.1% in the month. Mark LaNeve, Ford’s VP of US Marketing, Sales and Service said Ford’s monthly sales presentation:

Total U.S. sales for Ford were off 7%, with 214,695 vehicles sold. In retail, we were off 10.5% with a vast majority of loss coming from cars as consumers continue to move into SUVs and trucks. Looking at overall pricing for April, we had a very positive $1,900 increase in average transaction price across our portfolio, which far outpaced the overall industry’s $210 increase. Overall, incentive spending was down $458 sequentially for March and flat year-over-year, bucking the industry trend that I just said, the industry was up $300. On incentives as a percent of selling price was our lowest going back to 2015, reflecting our strong transactional pricing.

You can see on the chart below that vehicle sales have been dropping quickly in the U.S. since a recent peak in December of 18.3 million (annualized) vehicles.

It shouldn’t be too surprising that after seven years of extremely low interest rates that pulled forward a lot of demand for new automobiles there’s going to be a little giveback. The question is, will auto makers be able to prevent this from turning into a major sales slump?