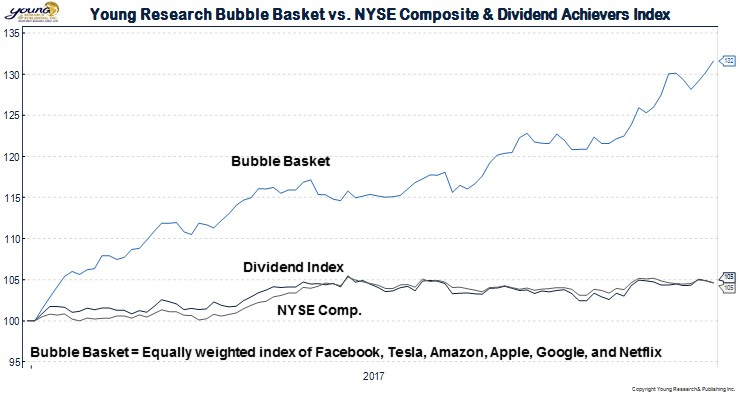

Speculation seems to be alive and well in the stock market. Young Research’s Bubble Basket index is up 32% YTD. Meanwhile, high quality stocks represented here by the Nasdaq Dividend Achievers Index, or if you prefer the NYSE composite, are up about 5%.

Did the value of the six businesses in Young’s Bubble Basket really increase by over 32% in just four months?

Hard to see how this ends well for those who still believe trees can grow to the sky. Retired investors and those soon to be retired are still best served by quality and balance.