By zimmytws @ Shutterstock.com

Amazon is offering a new credit card called Amazon Credit Builder to customers with credit scores that might not be good enough to get a card anywhere else. CNBC’s Kate Rooney reports:

Amazon is finding a way to get its rewards credit card in the hands of more people.

The e-commerce giant partnered with publicly traded bank Synchrony Financial to launch “Amazon Credit Builder” — a program that lends to shoppers with no credit history or bad credit, who would otherwise be exempt from Amazon’s loyalty cards.

“There’s always going to be people that we can’t give credit to — this is a large population that we weren’t able to reach,” Tom Quindlen, Synchrony executive vice president and CEO of the bank’s retail card operation, told CNBC in a phone interview. “It’s a new segment of the market.”

The card has the same perks, like 5% cash back on purchases, that come with the popular Amazon Store card, which Synchrony also powers. These rewards cards incentivize shoppers to use Amazon instead of an alternative and helps drive loyalty within its customer base, Quindlen said. Banks like J.P. Morgan have also bet on rewards cards would theoretically make customers spend more, and in turn bring in more interest and returns.

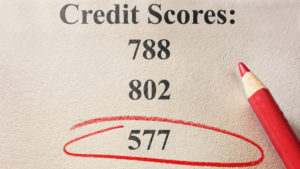

This new Amazon card could open the door to huge segment of U.S. buyers. According to a 2018 FICO survey, more than 11% of the population has a credit score below 550. About 4% of the population has a “bad credit score,” which according to FICO Score is between 300 and 499. Meanwhile according to a 2017 survey by the FDIC, 25 percent of U.S. households are either unbanked or underbanked.

Read more here.