Income investors can’t seem to catch a break. Even though the Federal Reserve is finally normalizing short-term interest rates, long-term interest rates remain depressed. The 2.2% yield on 10 year Treasuries isn’t much higher than it was during the last financial crisis. Based on the rate of economic growth, inflation, and the current Federal Funds rate, long-term interest rates should be much higher.

How much higher?

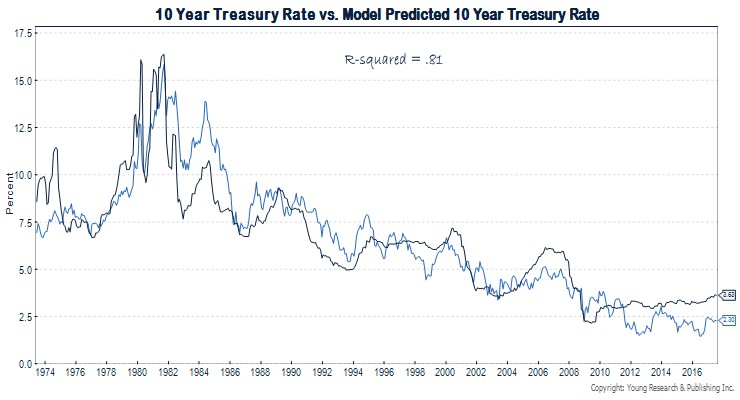

The chart below compares the actual 10-year Treasury rate (blue line) to the rate predicted (black line) by a simple model of economic growth, inflation, and short-term interest rates. Under current conditions, the model projects that 10-year Treasuries should yield 3.6%. That compares to a current rate of 2.2% as of yesterday’s close.

What’s preventing long-term rates from rising to a more historically normal level? Central banks are probably the biggest culprit. The Fed, the European Central Bank, and the Bank of Japan have bought up (and continue to buy in the case of the ECB and BOJ) trillions of long-term government bonds. A newfound belief among many investors that we are in a new normal with respect to long-term interest rates is also a likely contributor.

Whatever the cause, we see more risk than opportunity in long-term Treasuries. For retired and soon-to-be retired investors who may not have the luxury of decades of time to recover from a bond bear market, a shorter maturity portfolio focused on high-quality credits offers the more attractive risk-reward profile today.