A recent study performed by Australian scientists found that the human genome predicts the species’ lifespan to be about 38 years. Modern scientific discoveries and improvements in the standard of living have increased that to about 72 years worldwide and much higher in some developed countries. It should come as no surprise that the longer you live beyond the day you retire, the more you’ll spend during retirement on maintaining your standard of living. How long can you do that? 20 years? 500 years? Here’s how I explained the idea of living to 500, and how you can plan your investment portfolio for longevity.

Will You Live Forever? How About 500 Years?

In today’s brand-driven media cycle, anything promoted with the imprimatur of a trendy company like Google gets a full airing and lots of exposure, no matter how offbeat. Recently, president of Google Ventures (the corporate investment capital arm of Google Inc.) Bill Maris told Bloomberg that he believes humans can live to be 500 years old. Maris is not what you would consider a typical Google employee. He’s been trained in neuroscience, and helped develop Google’s Calico project to address ageing. No surprise, Silicon Valley’s young millionaires and billionaires want to live to enjoy their wealth for a very long time.

Maris says he hopes to live long enough not to die. That’s probably not going to be the case for most of today’s retired or soon-to-be-retired investors. But that doesn’t mean you can ignore the thought of outliving your money. There are a number of ways you can prevent portfolio ruin. The first and most obvious is to take a sharp pencil to your budget. For most of the last half-century, I have advocated a 4% draw on your retirement nest egg. Recently, I have advocated a lower draw (when possible) to minimize lasting damage from the Fed’s complete destruction of yield over the last seven years.

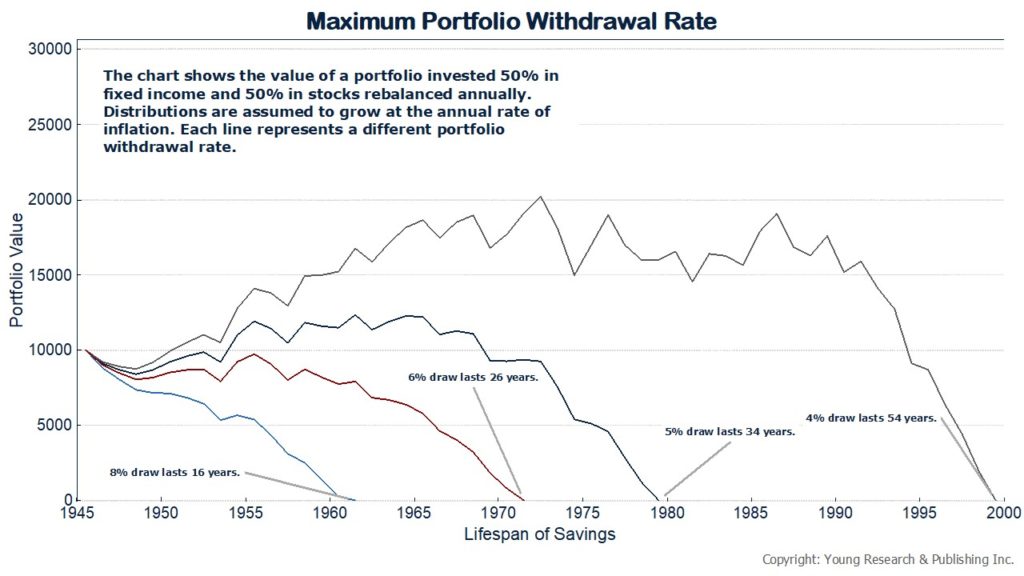

You can see on my Maximum Portfolio Withdrawal Rate chart below that an investor in 1946 with a 50/50 portfolio of stocks and bonds, rebalanced annually, would draw down his portfolio quite rapidly by taking 8% per year. Even drawing 7%, 6%, or 5% doesn’t inspire comfort, as each portfolio is depleted in less than 34 years. You may thinking that 34 years is plenty, but take a look at the timeline here. The bulk of this investor’s retirement took place in the ’50s and ’60s, when returns on a 50/50 portfolio were quite strong. In contrast, today’s bond yields are so low, you may not earn 4% on your savings, meaning you’ll have to save even more to live comfortably. Withdrawing 5% could force you to take up residence at the entrance to Wal-Mart greeting customers when you should be enjoying your golden years.

Another way you can protect yourself from drastic moves in the balance of your portfolio is to rely on its income to produce your 4% draw. Investing in companies with high dividend yields can help you achieve that income. Today, you face an investment climate where high dividend yields aren’t abundant. Take a look at the yield of the S&P 500 in my chart below. The average yield shown there (since 1945) is 3.4% for the index. Today, the index yield doesn’t even break 2%. Loose Federal Reserve policies going back to the 1990s have decimated yields by propping stock prices up into bubble territory. To mitigate the effects of low yields overall, you can prepare your portfolio for future income by selecting stocks of companies with policies that favor dividend increases year after year. If dividends increase 5% every year, after five years a stock with an initial yield of 2% will yield 2.6% on your initial dollar invested, and so on.

You can achieve a portfolio that keeps you and your family secure well into your retirement by focusing on buying the stocks of companies that will keep raising their dividends. That’s one of the areas we focus on for clients at my family-run investment counsel firm, Richard C. Young & Co., Ltd. If you would like to learn more about the strategies we use, click here to sign up for our monthly client letter (it’s free even for non-clients).

Originally posted on Young’s World Money Forecast.