Kirk Maltais of The Wall Street Journal reports that U.S. aluminum buyers are stockpiling before tariffs rise from 10% to 25%. Maltais writes:

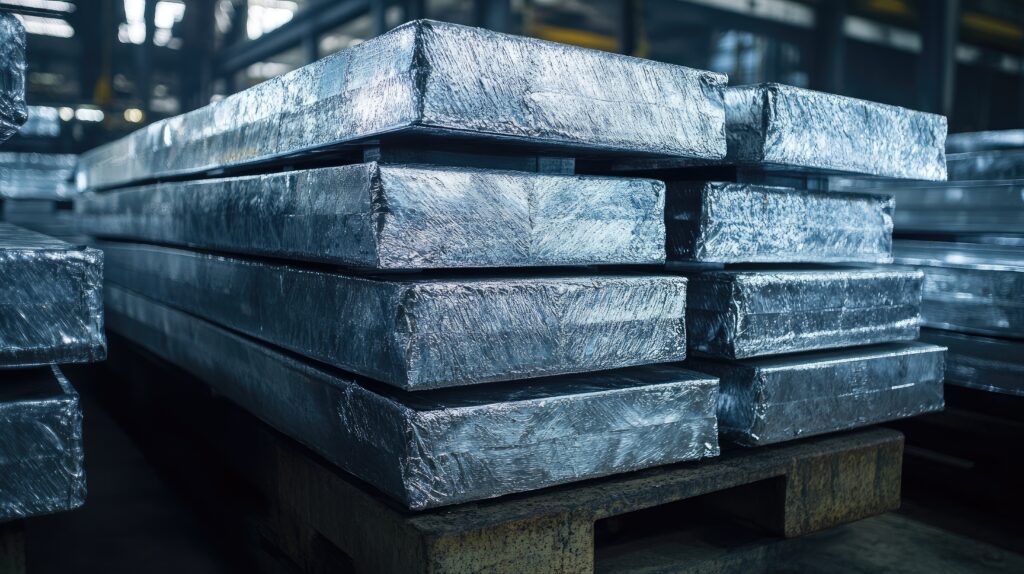

The tariffs targeting aluminum imports into the U.S. have buyers scrambling to procure the metal before the levies are expected to kick in and make imports more expensive.

Aluminum buyers – which include manufacturers of products like automobiles, beverage cans and home appliances – are attempting to stock up on primary aluminum before the Trump administration raises the 10% tariff placed on the metal to 25% starting next month.

The U.S. is a deficit market for aluminum, meaning that demand for the metal is higher than the amount that’s produced by domestic smelters. According to data from the Aluminum Association, imported aluminum accounts for nearly 60% of the aluminum used in the U.S., while the amount of aluminum produced in the U.S. continues to diminish. […]

This surcharge – known as the ‘Midwest premium’ – has quickly risen in the wake of the tariff announcement, with Platts, a part of S&P Global Commodity Insights, pegging its assessment at 38.55 cents a pound Wednesday. The firm’s assessment has climbed 65% from the start of the year, and it has surged nearly 30% since the White House confirmed new metal tariffs. […]

Canada supplies roughly 60% to 70% of the imports that come into the U.S. market. Canadian suppliers like Rio Tinto produce high quality aluminum that is typically sold to stateside buyers. […]

“Tariffs have not effectively increased U.S. aluminium production, as despite the premium doubling in 2018 after the previous Trump administration introduced tariffs, production remains below 2017 levels,” Fitch Ratings said in a note Wednesday.

Read more here.