Compound interest was described as the greatest mathematical discovery of all time by Albert Einstein. Compound interest “Tis the stone that will turn all of your lead into gold,” according to Benjamin Franklin. The late great Richard Russell explained compound interest as the royal road to riches. Below I’ll explain this powerful investment tool and show you how to read a compound interest table.

Compound interest is the heart and soul of investing. Investors lacking a solid grounding in compounding are more likely to suffer from a wandering eye. They can be inclined to favor Hail Mary tactics in their investment portfolios, where the goal of every buy is score big and fast (think options and cash burning startups). The downsides of such an approach are 1.) it rarely works and 2.) loads of volatility. In contrast, investors who truly understand and appreciate the awesome power of compound interest recognize that the combination of time and modest return is a better path to investment prosperity.

Compound Interest Table Still Best

It may surprise you, but in an industry with massive computing power, where algorithmic trading and quantitative models are now prolific, the best way to truly master the awesome power of compounding is still to study an old fashioned compound interest table.

A compound interest table gives you a sense of just how powerful compounding can be at varying rates of return and over varying time horizons. Sure, you can use a calculator or an Excel spreadsheet to find the future value of an investment, but that single data point doesn’t do compound interest justice. Studying the array of compounding factors and how they increase with respect to time and rate of return leaves an indelible mark on one’s mind.

To emphasize the power of compounding, we have included a compound interest table below.

Reading a Compound Interest Table

Move down each column on the compound interest table to see the effect of time on the multiplier. Move across each row on the compound interest table to see the effects of changing the rate of return. Take a look at the row that starts with the 20-year time-horizon. Now move across to the 5% annual rate of return column. Note the compounding factor of 2.65. If you invested $10,000 at a 5% interest rate for 20 years you would have $26,500.

Now staying in the same row, move across to the 10% return column and note the compounding factor of 6.73. That same $10,000 at a 10% compounded annual return would be worth $67,300 after 20 years. The return doubled, but your ending wealth more than doubled. Now double the return again. At a 20% annual rate of return $10,000 then becomes a whopping $383,400 after 20 years. The returned doubled again, but you’re your ending wealth would have increased by a factor of almost 6!

That is profound! And that is the awesome power of compound interest.

For an expanded printer-friendly version of our compound interest table that can be handed out to the kids and/or grand kids click here.

Compound Interest Table

Future Value of $1 at the end of n periods: FVIF k,i = (1+i) nwhere n= number of periods, i = rate of return

| Period | 5% | 7% | 10% | 16% | 20% |

|---|---|---|---|---|---|

| 1 | 1.05 | 1.07 | 1.1 | 1.16 | 1.2 |

| 2 | 1.1 | 1.14 | 1.21 | 1.35 | 1.44 |

| 3 | 1.16 | 1.23 | 1.33 | 1.56 | 1.73 |

| 4 | 1.22 | 1.31 | 1.46 | 1.81 | 2.07 |

| 5 | 1.28 | 1.4 | 1.61 | 2.1 | 2.49 |

| 6 | 1.34 | 1.5 | 1.77 | 2.44 | 2.99 |

| 7 | 1.41 | 1.61 | 1.95 | 2.83 | 3.58 |

| 8 | 1.48 | 1.72 | 2.14 | 3.28 | 4.3 |

| 9 | 1.55 | 1.84 | 2.36 | 3.8 | 5.16 |

| 10 | 1.63 | 1.97 | 2.59 | 4.41 | 6.19 |

| 11 | 1.71 | 2.1 | 2.85 | 5.12 | 7.43 |

| 12 | 1.8 | 2.25 | 3.14 | 5.94 | 8.92 |

| 13 | 1.89 | 2.41 | 3.45 | 6.89 | 10.7 |

| 14 | 1.98 | 2.58 | 3.8 | 7.99 | 12.84 |

| 15 | 2.08 | 2.76 | 4.18 | 9.27 | 15.41 |

| 20 | 2.65 | 3.87 | 6.73 | 19.46 | 38.34 |

| 25 | 3.39 | 5.43 | 10.83 | 40.87 | 95.4 |

| 30 | 4.32 | 7.61 | 17.45 | 85.85 | 237.38 |

| 35 | 5.52 | 10.68 | 28.1 | 180.31 | 590.67 |

| 40 | 7.04 | 14.97 | 45.26 | 378.72 | 1469.77 |

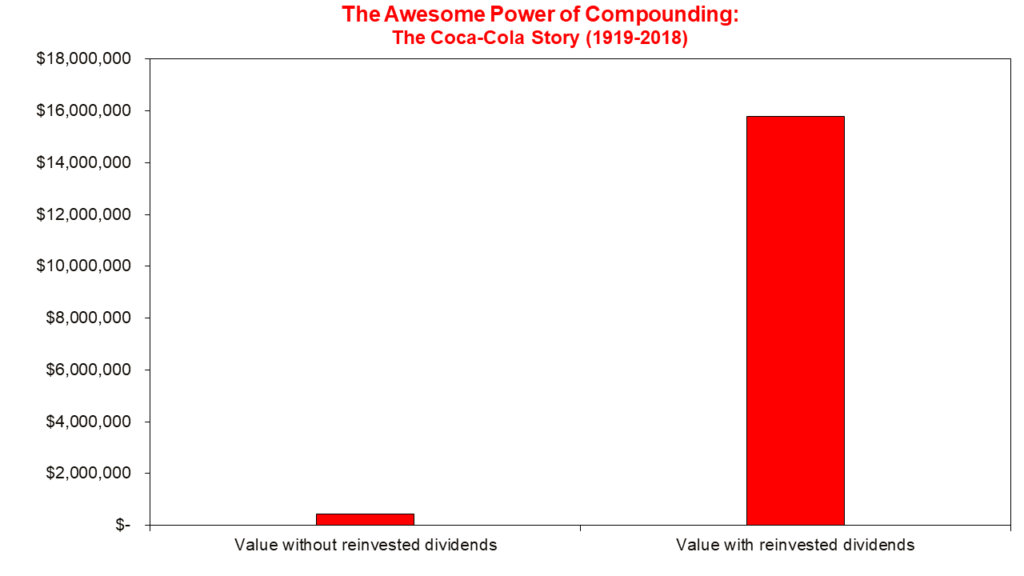

A Real World Example of the Awesome Power of Compounding

For a truly awesome example of the power of compounding consider the Coca-Cola story. If an investor purchased $40 of Coca-Cola (KO) stock in 1919 and spent all of his dividends, the total value of his investment at year-end 2018 would have been an impressive $436,000. Not a bad return, but if that same investor instead chose to smartly reinvest dividends, his initial $40 investment would have grown to almost $16,00,000 by year-end 2018. The power of compound interest truly is the royal road to riches.