President Donald J. Trump, joined by Vice President Mike Pence, participates in an Armed Forces Welcome Ceremony in honor of the 20th Chairman of the Joint Chiefs of Staff Monday, Sept. 30, 2019, at Summerall Field, Joint Base Myer-Henderson Hall, VA (Official White House Photo by Shealah Craighead)

Despite the ongoing trade war and skirmishes in the Middle East, stocks posted their best three first three quarters since 1997. Gunjan Banerji writes in The Wall Street Journal:

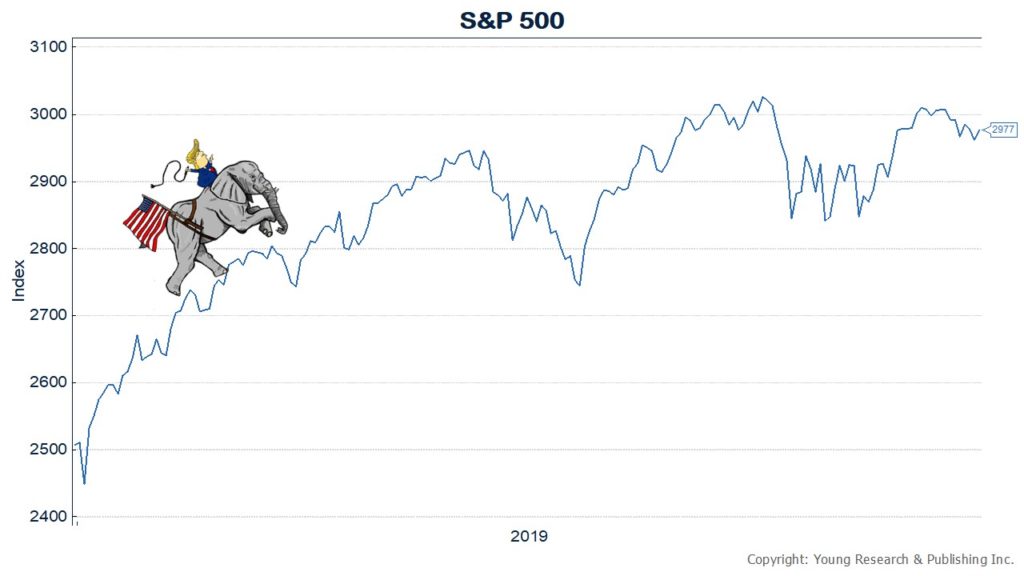

The S&P 500 is now sitting just 1.6% below July 26’s all-time high, but it has also risen a mere 2.2% from a year ago after a brutal selloff last fall—encapsulating the sideways trading pattern that has gripped markets since the beginning of 2018.

The quarter ended on a relatively quiet note. The S&P 500 ticked up 0.5% to 2976.74 Monday, paced by Apple, which closed at its highest level this year.

Underneath the surface, it was a dizzying three months for markets.

Stocks surged to new highs in July ahead of the Federal Reserve’s first cut to interest rates in a decade, but then dropped in August—with the Dow Jones Industrial Average suffering its biggest decline of the year—as the long-simmering trade war with China escalated and fears of a U.S. recession bubbled.

Major indexes clawed back those losses in the following weeks as investors rotated out of some of the momentum stocks that have propelled the decadelong bull market, in favor of shares that appeared undervalued.

Tax cuts and regulatory reform have created a strong business climate in the U.S., encouraging many investors to abandon the slow-growing economies of the emerging markets and to seek safety in American securities.

You can see on my chart below that despite volatility, the S&P had its best quarter in 22 years.

Originally posted on Your Survival Guy.