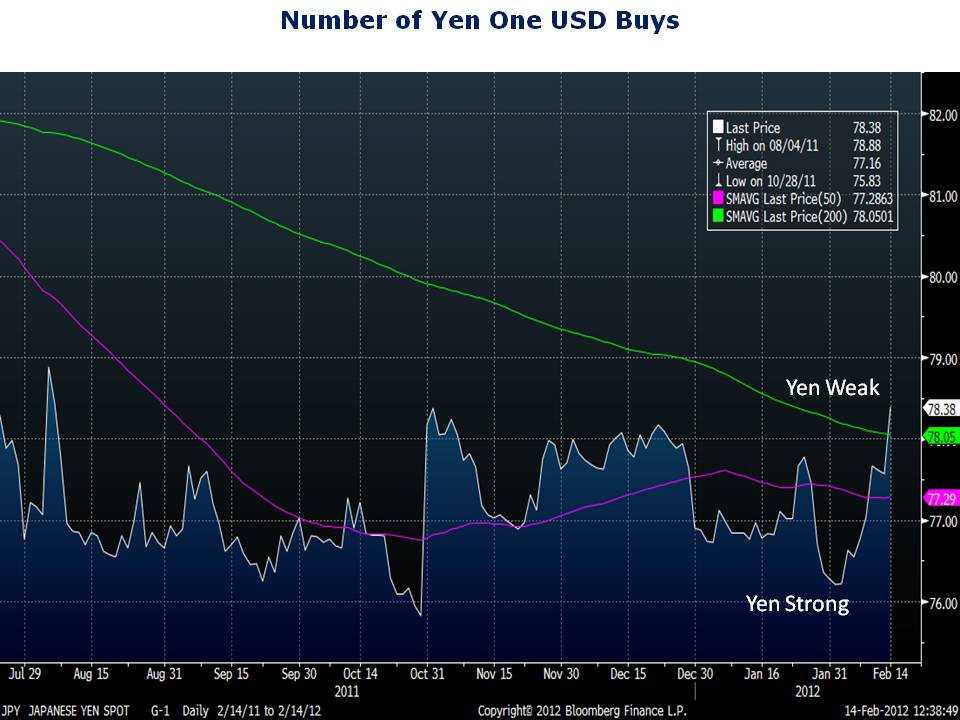

Not to be outdone by Europe or the U.S., the Bank of Japan announced yesterday that it would print an additional 10 trillion yen ($128 billion) to expand the size of its asset-purchase program. The BOJ’s decision comes on the heels of the European Central Bank’s December decision to massively expand its balance sheet and the Bank of England’s decision to increase the size of its own money printing campaign. The yen tumbled vis a vis the U.S. dollar and the euro on the news. The BOJ’s decision is yet more evidence of coordinated global fiat currency devaluation by the world’s largest central banks. This can’t end well. If you don’t yet own some gold, now is the time to consider a position.