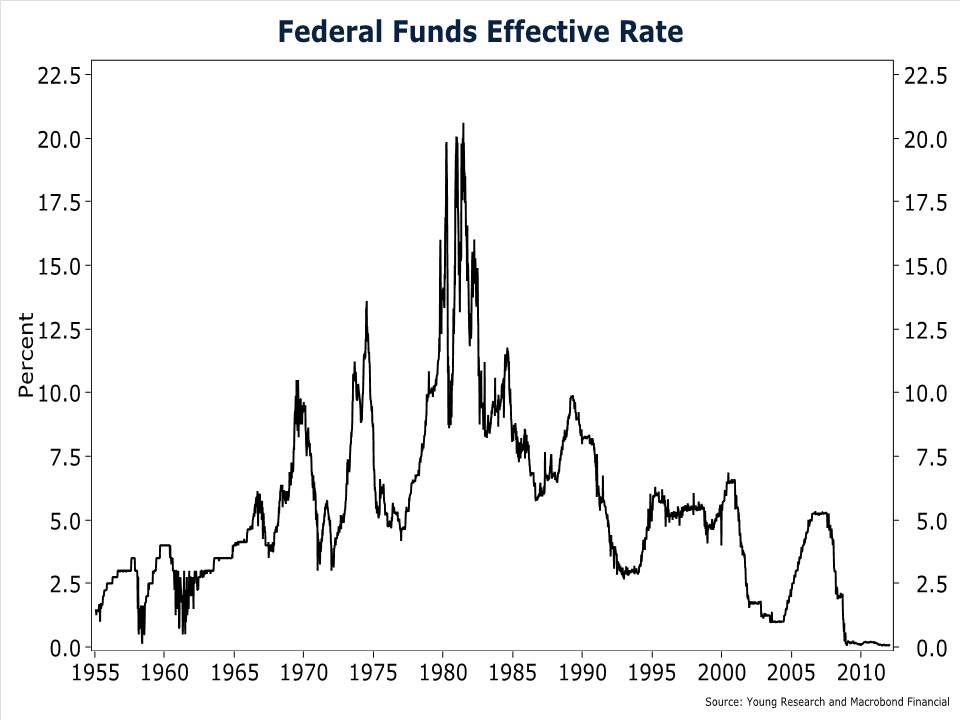

In this 0%-interest-rate environment, public pensions like Rhode Island’s are using an assumed rate of return of 7.5%. If and when that estimate goes unmet, it’s up to taxpayers to make up the difference.

It’s preposterous that public pensions are assuming a 7.5% rate of return. The only way they’ll meet their mark is to take on more risk. That’s a bad four-letter word for any investor—never mind retirees. Money managers will attempt to meet their hurdle with other people’s money. But they have no skin in the game, so why not swing for the fences?

In the private sector, the idea of retiring in your 40s and collecting a lifelong pension is absurd. Yet that’s been happening all along with public pensions. UPS Inc.’s earnings dropped 29% in the fourth quarter simply by shifting to a mark-to-market system. They’ve owned up to the fact that the returns just aren’t there. In dollar terms, after-tax charges in 2011 and 2010 were $527 million and $75 million, respectively. Crushed by its pension liability, American Airlines has filed for bankruptcy.

We haven’t even begun to see how painful this is going to be. Yes, there have been both private and public bankruptcy filings, but wait until the pain from low interest rates really kicks in. Retirees will be without income and on the hook with higher taxes to pay for public pensions. And if interest rates go up, long-term bonds will be destroyed—and neither of these scenarios is good.