The late great Richard Russell, writing about the third phase of a bull market, called it the speculative phase.

The third phase was when the average Joe couldn’t stand missing the boat.

The third phase was when momentum would take over, and any reasonable measure of valuation would be kicked to the curb.

Bitcoin certainly seems to me to be in a third phase, but it also feels too young to even begin measuring which phase we’re in—the whole thing feels like a speculative third phase to me.

Steven Russolillo of the WSJ, an expert on bitcoin writes, “Bitcoin, which started 2017 at about $1,000, has now hit eight different 1,000-point milestones this year alone. That stands in contrast to the 1,230 days it needed to initially hit $1,000, and to the 1,269 days it took after that to go from $1,000 to $2,000.

Of course, simple arithmetic shows that the more the digital currency rallies, the smaller percentage gain it takes to achieve these thousand-point milestones. A move from $1,000 to $2,000 is a 100% gain, whereas an increase from $8,000 to $9,000 is a 13% gain.”

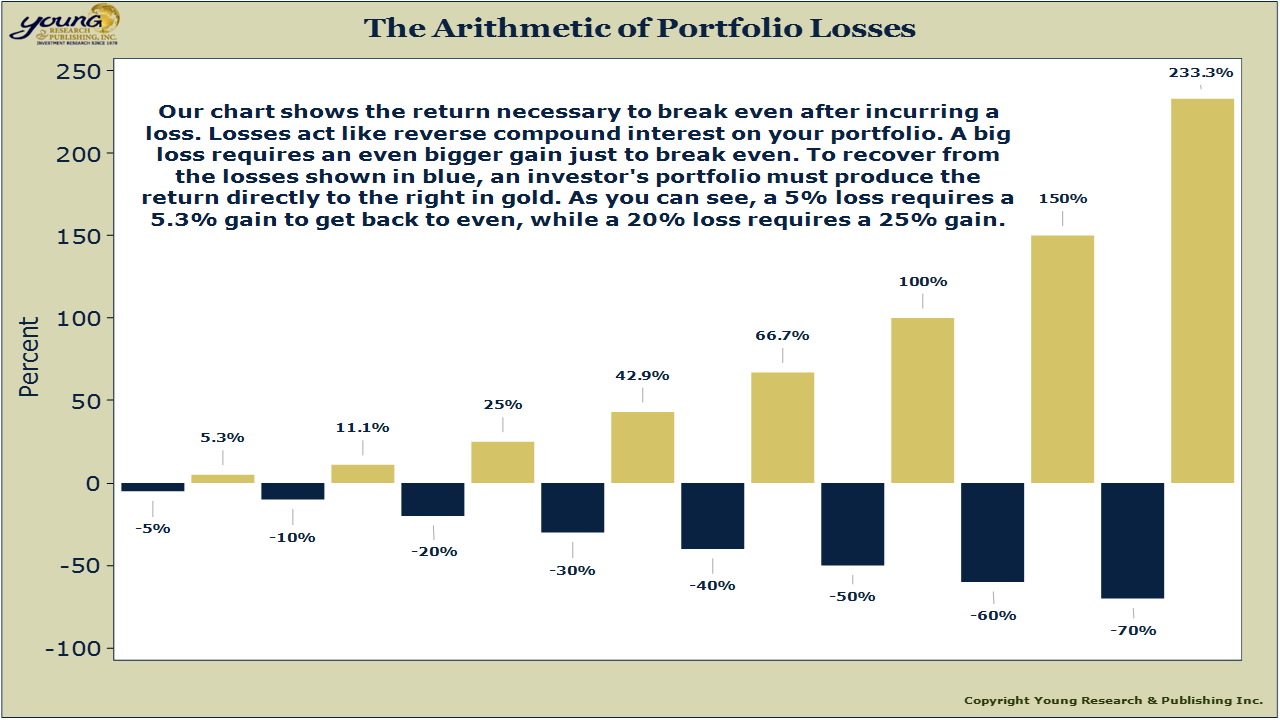

Another point worth making is the math of losses: A 50% loss requires a 100% gain to get back to square one, and so on (see the chart below for more).

Bitcoin will go as high as the next guy is willing to pay for it, but not with my money.

Originally posted on Yoursurvivalguy.com.