When exactly should you start worrying about bitcoin volatility? Online trading platforms are beginning to get concerned about the crypto-currency’s meteoric rise.

Hannah Murphy writes for the Financial Times:

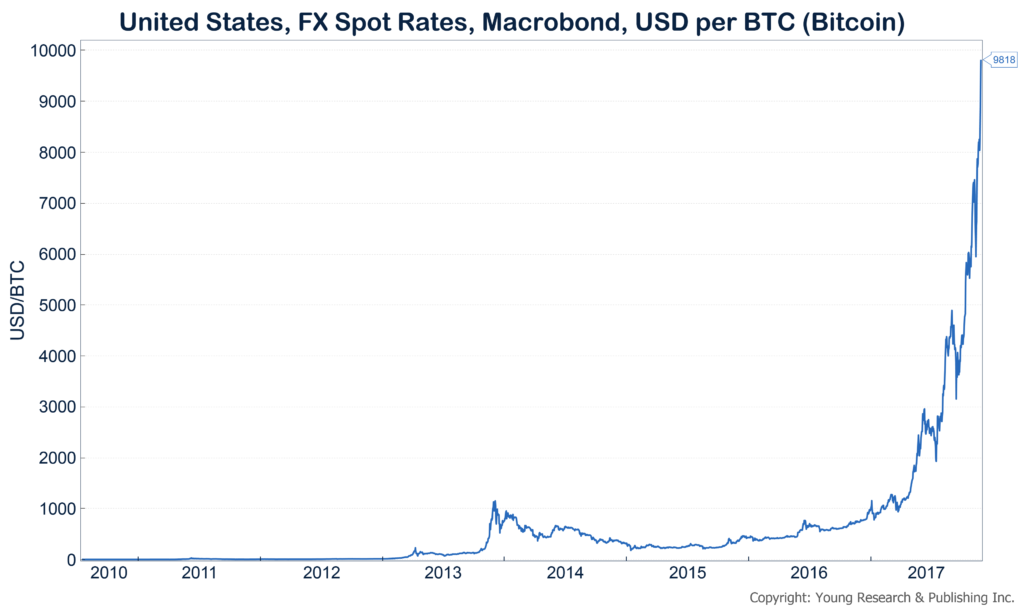

Bitcoin’s value has risen more than 850 per cent from about $1,000 at the start of the year to a high on Monday of $9,747, an ascent that masks dramatic drops along the way. IG Group, the world’s largest online trading platform, told the Financial Times it had suspended trading of some of its bitcoin derivatives on Monday after roaring demand for the products left the company facing a high security risk. Other online marketplaces, including Plus500, have raised the fees they charge in dollars to hold an open position in bitcoin, with some demanding what would amount to 175 per cent of the trade over the course of a year.

Screaming volatility feels great when the value of your portfolio is increasing. Not so much when it’s headed the other way.

Investors should ask themselves just how much of their portfolios they’re willing to devote to a holding as volatile as bitcoin.

Whether bitcoin has longevity, or is in a bubble, or can ever sustain itself doesn’t matter nearly as much as maintaining your own investment plan. The reality is, no one can plan for volatility in their portfolio like what bitcoin is bringing to them today.

Originally posted at Yoursurvivalguy.com.