Years ago, talking with Dick about Richard C. Young’s Intelligence Report, I asked him, “Dick, what do you think about when you sit down to write?”

“Simple,” he said. “I imagine there’s a giant pile of cash sitting on my desk, and I need to get it invested.”

Talking with Dick this week about the Fed’s rate cut and the market’s response, I’m reminded of another conversation we had. “Remember,” he said. “Bonds trade like stocks, and the market sets the prices and interest rates beyond a narrow band controlled by the Fed.” Yes, the Fed controls the short end of the curve, as you can see cash yields coming down. The 10-year? Not so much. That’s Mr. Market.

And look at the yield curve. Cash returns for Main Street are coming down.

Your Survival Guy wants you to make sure you have your bond component where it needs to be. This is no time to get cute and try to predict where interest rates are headed. Understand the most basic tenet of bonds is that you’re the creditor. You’re the bank. And with the capital structure, you get paid before common shareholders. It’s never fun being common when times get rough. Therefore, I want you to be a bond owner.

As an aside, I also would like you—not your bank—to own your home. Forget about the interest deductions and think about the peace of mind and the reward of getting the bank off your back.

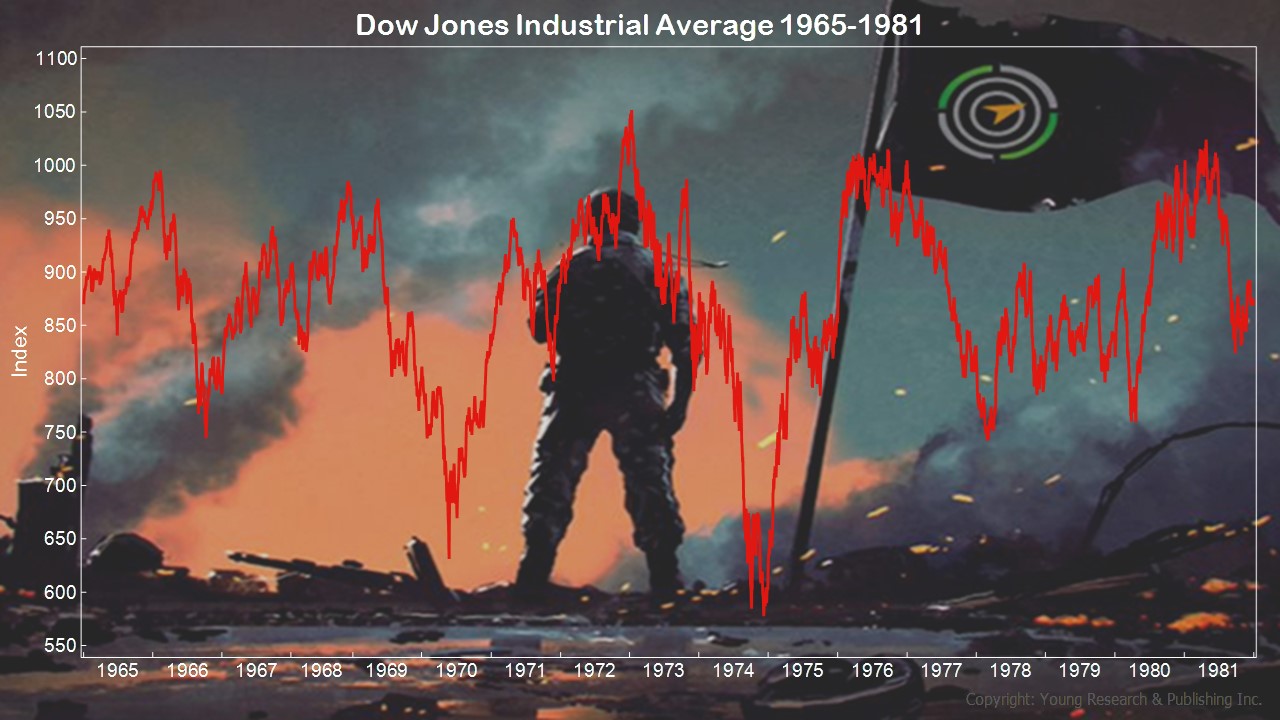

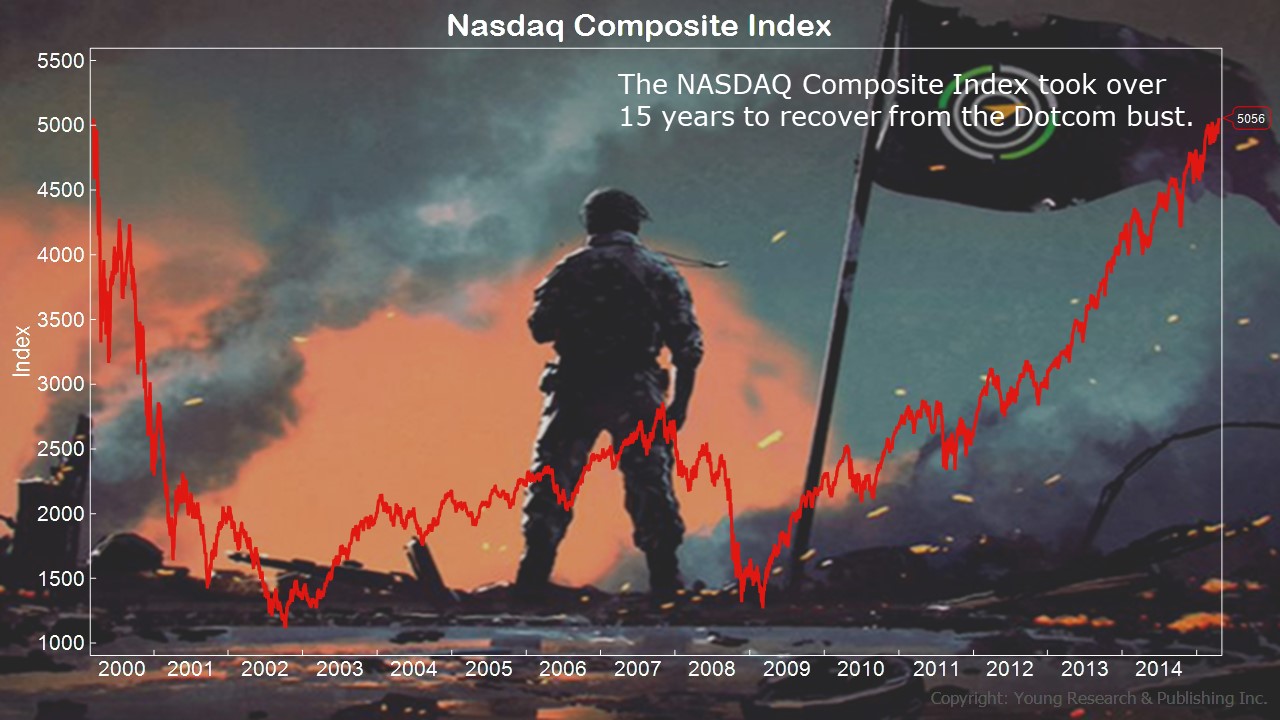

As for the stock market, get some dividend religion. Be paid to be in this market. You may be surprised to see how long stocks can stay flat.

Action Line: In my conversations with you, you’re telling me about your cross-country trip. I heard about how you’re going to Dollywood while in Tennessee and that you’re on the trip with friends from high school. How nice. That’s why you have your savings: to do what you want to do when you want to do it. Because you put that pile of cash to work years ago. When you want help with your pile of cash, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.