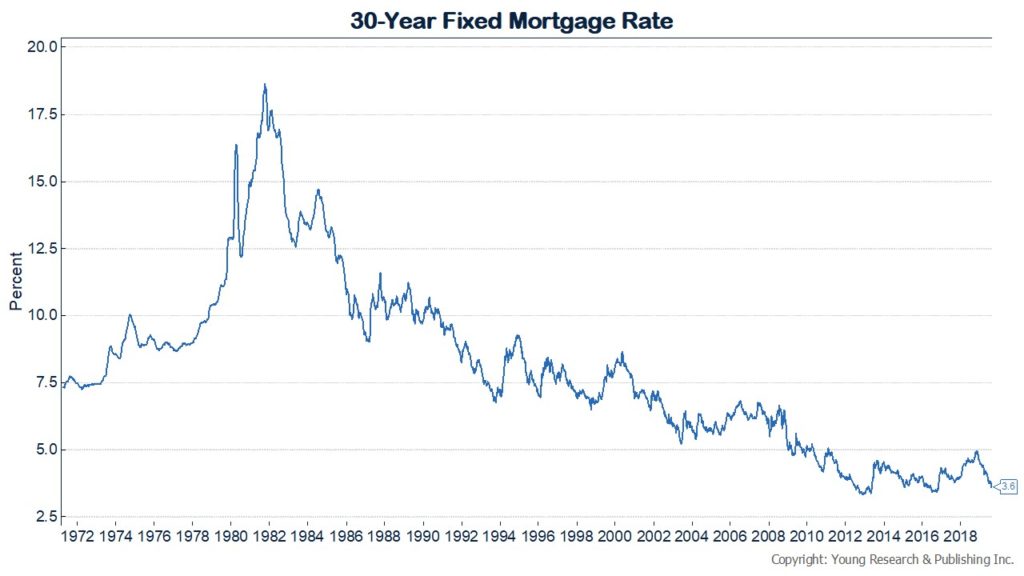

Mortgage rates are hitting lows not seen since 2016. But do low rates even matter if housing prices are unaffordable? MarketWatch’s Jacob Passy reports:

“There is a tug of war in the financial markets between weaker business sentiment and consumer sentiment,” Freddie Mac FMCC, -1.54% said in its report. “Business sentiment is declining on negative trade and manufacturing headlines, but consumer sentiment remains buoyed by a strong labor market and low rates that will continue to drive home sales into the fall.”

Ultimately, the low supply of homes available for sale will at least partially stymie any boost low mortgage rates would otherwise give to the housing market.

“Rates are low, but does it matter if you can’t find anything you can afford?” said Nela Richardson, an investment strategist at Edward Jones.

This is especially bad news for would-be home buyers who could stand to save significantly, given how home prices have reached record highs across much of the country. “Some millennials are missing out on a once-in-a-generation opportunity because we think rates will go up again,” Richardson said.

But some experts are hesitant to say that the declines in mortgage rates throughout 2019 will meaningfully provide a lift to the housing market.

The week’s drop in mortgage rates did spur a major uptick in home-loan applications, but most of this activity centered on refinances rather than loans used to purchase homes.

Read more here.