This month’s Industrial Production and Capacity Utilization report from the Federal Reserve fell short of economists’ predictions. Capacity utilization remained essentially flat in April, with growth failing to meet analysts’ expectations. Parts shortages created by the continued troubles in Japan contributed to the lackluster performance of American industry.

If you’re not familiar with capacity utilization rate, it is the percentage of total possible production an industry is employing at any given time. In other words, if I own a machine that can make 1,000 baseballs a day, and I’m making 800, my capacity utilization rate is 80%. There is almost never a 100% utilization of capacity. Because of maintenance downtime, strikes, and other unplanned stoppages, there is always a certain portion of capacity kept offline. But low demand can force even more capacity offline, and it forces companies to compete on price to supply the depressed demand. During a recession, capacity utilization rates drop because labor is sent home, and plants, factories, mines, and mills are idled.

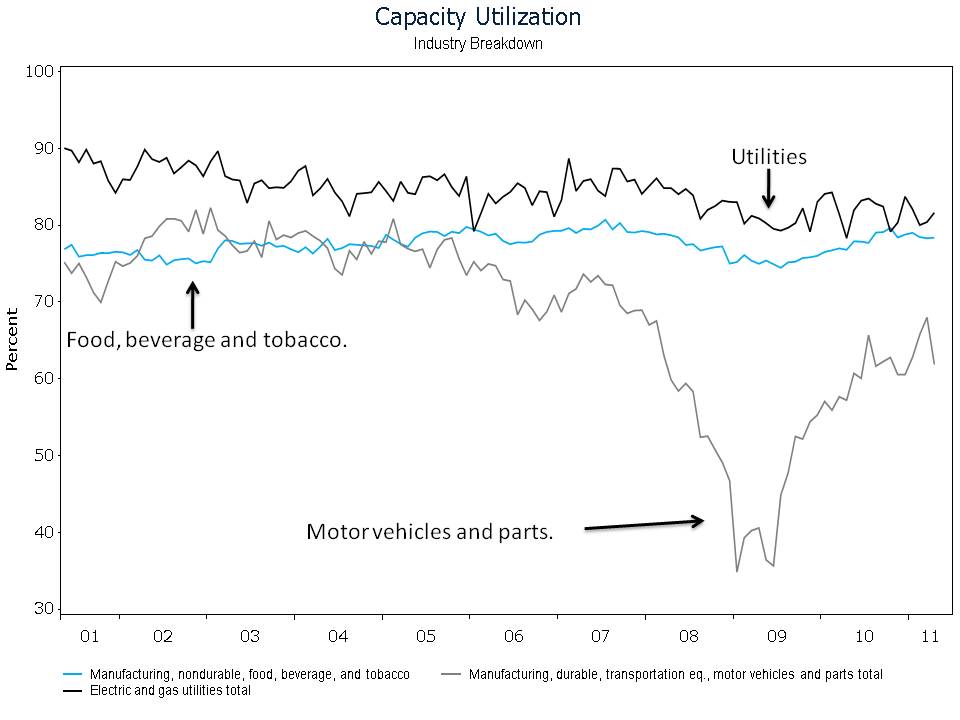

In the most recent recession, cyclical industries were hit hard, with motor vehicle capacity utilization reaching as low as 34.8%. Some industries are still struggling. In April, the communications equipment industry was actually operating at 5.4 percentage points below its recession low utilization rate.

But unlike in the cyclical industries, utilization rates for noncyclical industries rarely experience savage declines during economic contractions. In the recent recession, the utilities and food and beverage industries’ capacity utilization rates only dropped to 79.2% and 74.5%, respectively. That’s not far from their 10-year historical averages of 84.5% and 77.5%. Since the recovery started, the utilization rates of the utilities and food and beverage industries have risen 2.4 and 3.9 percentage points, with gains coming in April for both industries. Compare these two industries to the motor vehicles and parts industry on my chart, you can see the difference in the effect a recession can have. The sustained high level of capacity utilization in these industries gives companies greater control over prices. With less unused capacity in the industry, companies don’t fear being undercut by competitors when they raise prices. In the current environment of surging raw materials prices, it’s industries with pricing power that have appeal.