The number of new housing starts reported in April was a big disappointment. The 523,000 starts didn’t even break into the consensus range predicted by a Bloomberg survey of economists. The economists figured on 570,000 starts as the most likely number, but were disappointed when results came in 8.2% below their expectations.

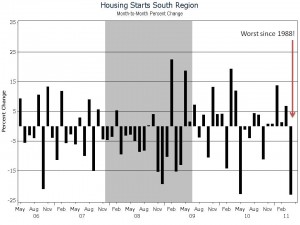

There were regional pockets where the numbers looked very bad. In the South, the number of new housing starts fell by 23% compared to March, the largest single-month decline since 1988. There were only 255,000 housing units started in the South in April, the lowest number in 24 months. The dip back down to April 2009 levels indicates sustained weakness in the housing market.

Homebuilders agree with the dismal assessment of the housing market. On Monday the NAHB / Wells Fargo survey of homebuilder confidence reported a very low confidence level of only 16 for the month of May. NAHB economist David Crowe says that buyers are reluctant to buy homes and “90 percent of builders surveyed said clients are concerned about being able to sell their existing home at a favorable price, while 73 percent said consumers think it will be difficult for them to get financing. Clearly, access to credit for both builders and buyers remains a considerable obstacle to the revival of the new-homes market.”

With interest rates having only one way to go (up) and uncertainty about the future of home lenders Fannie Mae and Freddie Mac, there is no telling what lies in store for the housing market.