Since March retail sales were released on the 12th, things have looked pretty ugly in the markets. The -0.4% drop in retail sales was broad based, with most of the components down. The realization you should take away from this is not that markets have suddenly begun showing weakness, but that instead markets are now showing how weak they would have been in absence of the artificial boost created by the stimulatory payroll tax holiday.

[expand title=”Click here to read more.”]

After retail sales disappointed, a number of other economic indicators underperformed expectations. The Empire State Manufacturing Survey Index dropped to 3.05 from 9.24 after analysts predicted a smaller drop to 7.5. The NAHB Housing Market Index fell to 42 from 44 even as analysts forecasted an increase to 45. CPI recorded a slight negative of -0.2%, which is good for savers in the short term but also indicative of economic slowdown. Initial jobless claims increased more than predicted (they fell back down this morning), the Philly Fed survey disappointed, and the Conference Board’s Leading Economic Indicators index dropped. Existing home sales fell, new home sales missed estimates, and durable goods orders plummeted.

The only bit of seemingly good news in the last two weeks was an increase in industrial production. But even that was suspect as the increase came only from higher output by utilities, not from the much more economically dynamic manufacturing portion of the report.

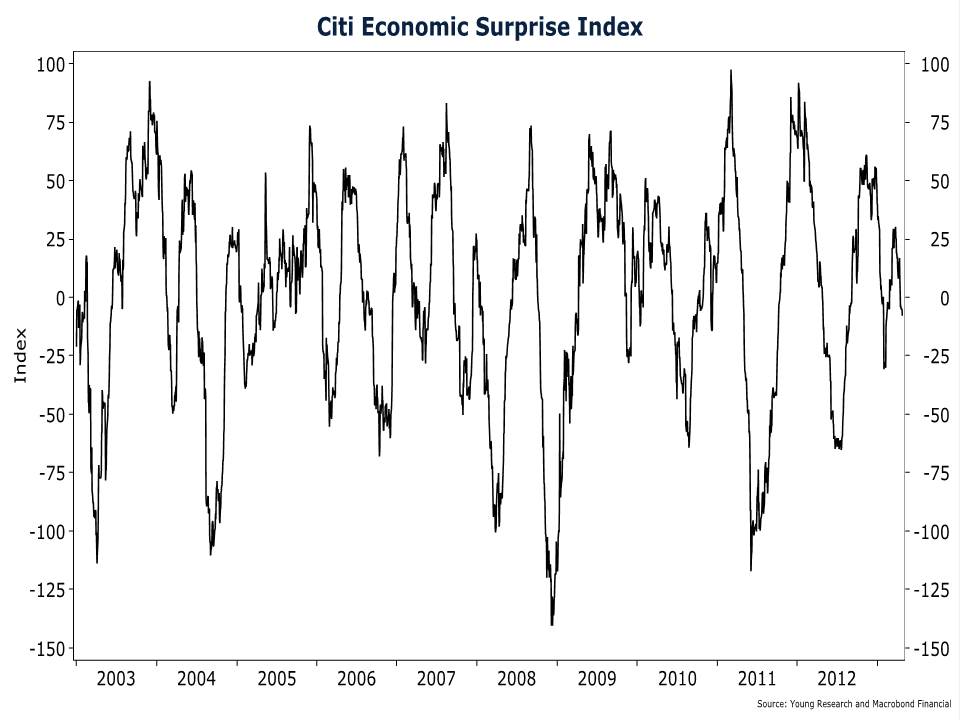

The distillation of all this bad news is the Citi Economic Surprise Index which fell below zero once again on April 16. A drop below zero doesn’t indicate immediate recession, but it is a negative sign for the future.

So what does all that mean for investors? If you look at the S&P 500 or the Dow Jones Industrials, you see advances. We won’t rehash the theory that massive amounts of central bank money are propping up markets, that seems self-evident at this point. What’s more important now is, what do you do if you’re trying to pick investments in this up-is-down, down-is-up environment? Craft a strategy built on long-term fundamentals, while avoiding the trend-of-the-day trading which winds up costing many people more money than they earn.