With the stock market just now correcting off all-time highs, a casual market observer may think that times are quite good. Prices are going up, right? Investors are getting wealthier, right?

[expand title=”Click here to read more.”]

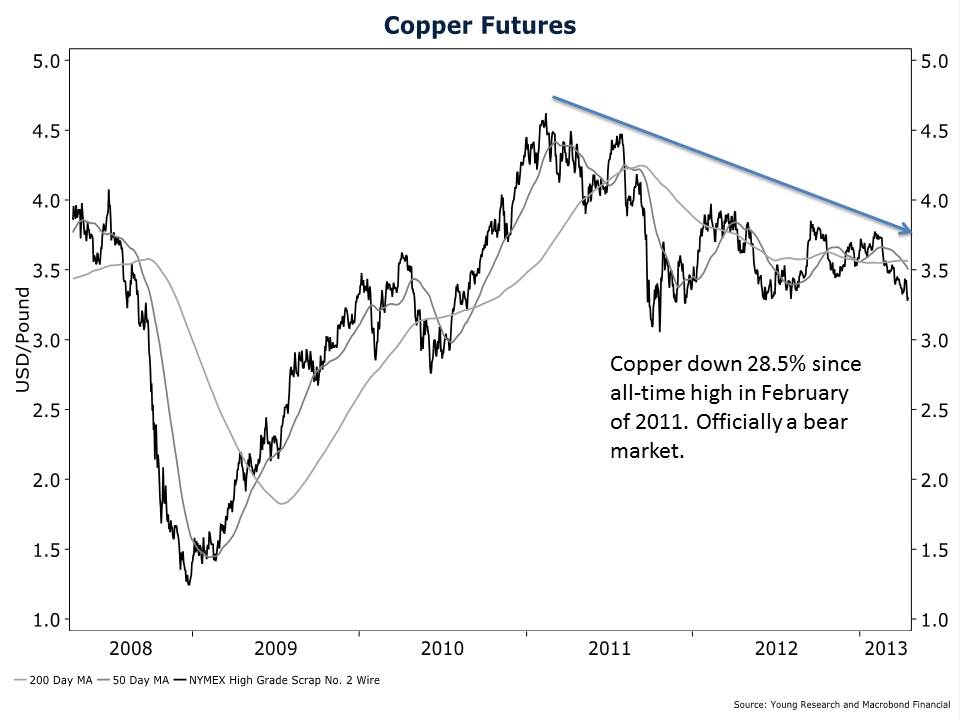

That’s what you might think if you viewed markets narrowly, without taking into account that commodities prices are plummeting. Take for instance the price of copper. We often call it “Doctor Copper,” because the red metal “has a PhD in economics.” When prices for copper fall, an economic downturn is usually close behind, making it a great predictor.

Well, copper peaked back in February of 2011. The price is over two years into a decline from its all-time high. The price per pound is down 28.5% since then, an official bear market. So what gives? Why are stocks soaring while copper has been signaling a dismal environment for over two years?

Reiterating that the Federal Reserve is propping up stock prices to foster the “wealth effect” among Americans would be old news for most of our readers. Another way to look at the discrepancy between copper and stocks is to look at why copper is falling (as opposed to why stocks prices are rising).

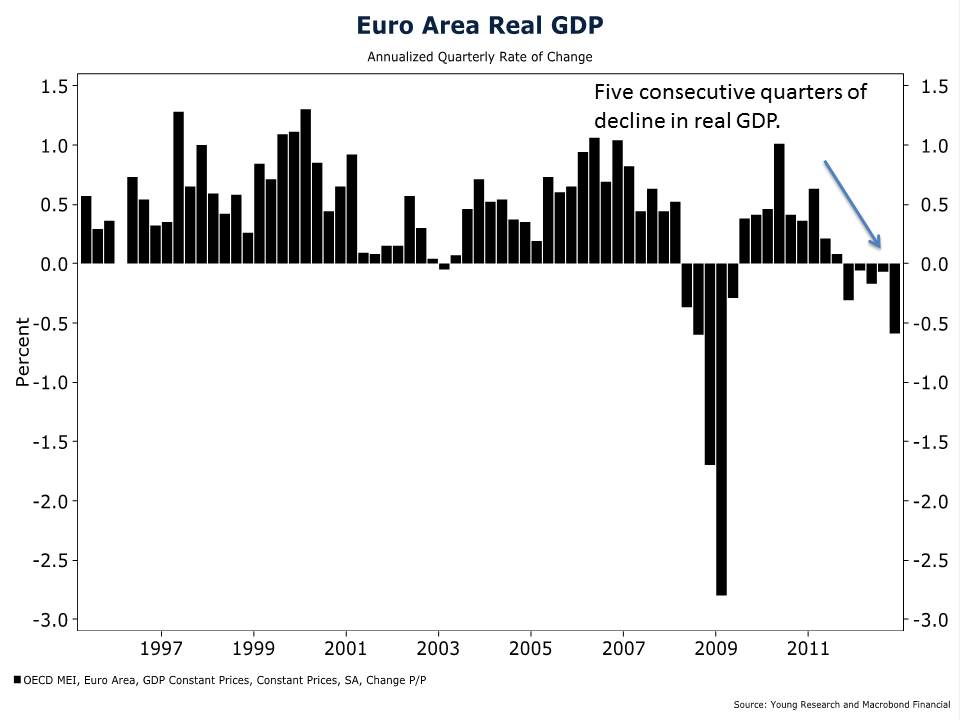

Chief among the reasons demand for copper has plummeted are the five consecutive quarters of GDP decline among the euro area countries. The current recession in the euro area has gone on as long now as the so-called Great Recession did. Unlike the Great Recession however, today’s recession may get worse before it gets better. The OECD doesn’t believe Greece’s economy will grow until the end of 2014.

Combine Europe’s woes with slowing economic growth in China, increasing tension on the Korean peninsula, lower economic growth forecasts for India, a Russian economy many expect is already in recession, and a slowing Brazilian economy and you don’t get much hope. In light of those facts, would you rather place your money on signals from Dr. Copper or those from Dr. Bernanke?

[/expand]