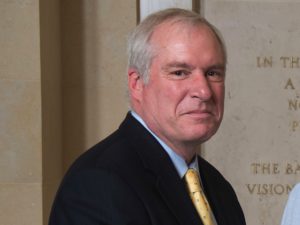

Has the Federal Reserve finally caught on that housing prices have been rapidly rising? Is it too late to prevent a bust? It seems Eric Rosengren, president of the Boston Fed, might be starting to pay attention to housing. The FT’s James Politi and Colby Smith report:

A senior Federal Reserve official has warned the US cannot afford a “boom and bust cycle” in the housing market that would threaten financial stability, in a sign of growing concern over rising property prices at the central bank.

“It’s very important for us to get back to our 2 per cent inflation target but the goal is for that to be sustainable,” Eric Rosengren, the president of the Boston Fed, told the Financial Times. “And for that to be sustainable, we can’t have a boom and bust cycle in something like real estate.

“I’m not predicting that we’ll necessarily have a bust. But I do think it’s worth paying close attention to what’s happening in the housing market,” he said.

According to data released by the National Association of Realtors last week, the median price for sales of existing homes was up 23.6 per cent year-on-year in May, topping $350,000 for the first time.

Rosengren said that in the Boston property market, it had become common for cash-only buyers to prevail in bidding contests, and that some have been declining home inspections to gain an edge with sellers.

“You don’t want too much exuberance in the housing market,” Rosengren said. “I would just highlight that boom and bust cycles in the real estate market have occurred in the United States multiple times, and around the world, and frequently as a source of financial stability concerns.”

He said the roaring housing market should be a factor as the central bank considers slowing or removing some of the hefty monetary support for the economy introduced during the coronavirus pandemic.

The Fed has been purchasing $40bn in agency mortgage-backed securities per month alongside $80bn in monthly Treasury debt as part of its asset purchase programme.

Fed officials are now beginning to discuss trimming that bond buying. And Rosengren said that “when it is appropriate” to begin that process, mortgage-backed securities purchases should be reduced at the same rate as Treasury purchases. That would mean the direct support to housing finance would wind down more quickly.

“That would imply that we would stop purchasing MBS well before we stopped purchasing Treasury securities,” he said.

James Bullard, president of the St Louis Fed, is among those who have called for the Fed to re-evaluate its support for the housing market against the backdrop of what he noted were broader concerns about a nascent bubble.

Robert Kaplan, Dallas Fed president, has also advocated for the purchases to end “sooner rather than later”, especially given mounting evidence of financial speculation in the housing market.

Read more here.