Earnings Could Spoil the Party

Wells Fargo analyst, John Manley, CFA writes:

I don’t think stock market valuation will be a negative (although it probably won’t be a positive, either). By my count, the current S&P 500 Index price to forward bottom-up consensus earnings expectations is between 15.5 times and 16.5 times. That is also between the 30-year and 20-year trailing average of that number. The good news is that valuations are probably not high enough to offset an improvement in the fundamentals. The bad news is that they are not low enough to support us if those fundamentals turn sour. I suspect that, as usually is the case, valuations will be a result of market conditions, not a cause of them.

No, more and more, I worry that the risk is in a potential decline of earnings expectations. To give some context, I have included a graph showing forward earnings-per-share (EPS) expectations since 2005. Super-imposed on that line are the lines representing consensus expectations for the calendar years in that period. The reader will note that the forward line tends to rise (but not always) while the annual lines tend to diminish as time progresses. The latter fact should come as no surprise to those who realize that analysts’ first stabs at a company’s earnings in the somewhat distant future is no more than an approximation of potential earnings that will evolve into more realistic (and lower) numbers as time progresses. Its decline usually is natural and not the result of some business contraction.

This chart shows earnings, not valuations or the Fed, might spoil the party https://t.co/iPEuLsZmbj pic.twitter.com/34vlNYy8lG

— Wells Fargo AssetMgt (@WFAssetMgmt) March 4, 2016

BofA: Blame the Fed

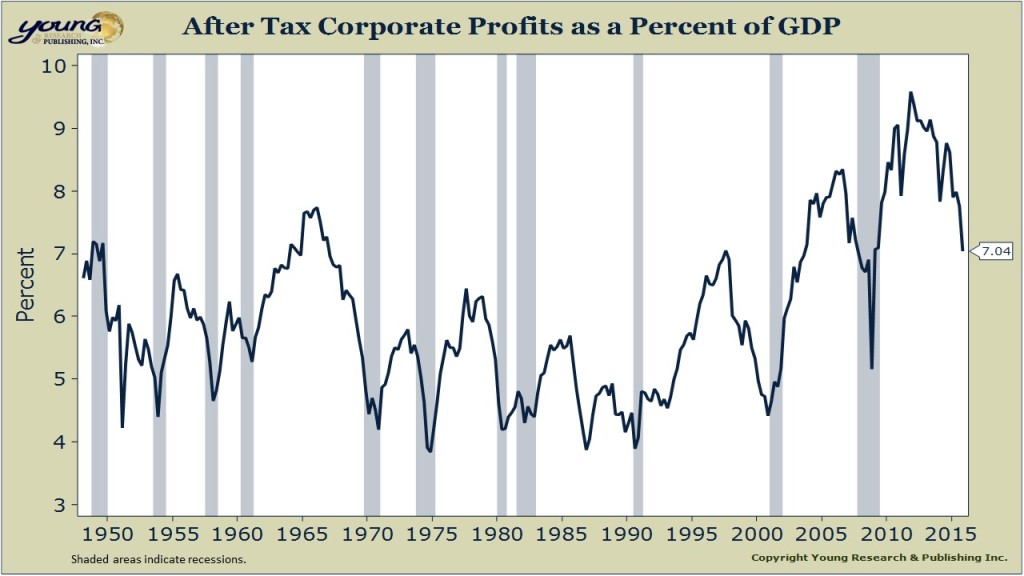

Profits Diving as a Percent of GDP