The jobs report was released this morning and number of new jobs created in August came in at 173,000, missing estimates by about 44,000 jobs or 0.02% of the total U.S. labor force, but last month’s number was revised up by 30,000 jobs.

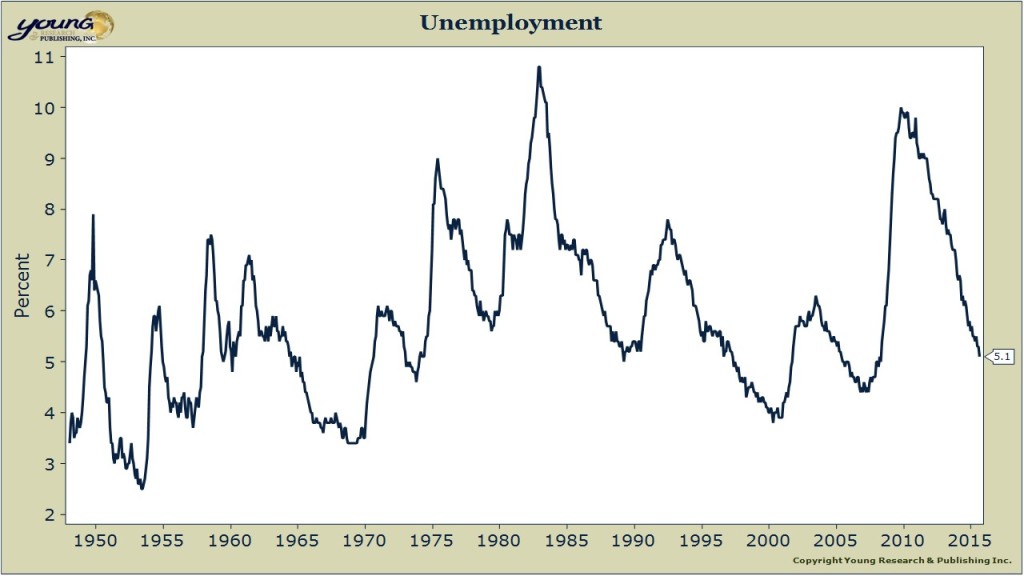

The unemployment rate fell to 5.1%, which is dead smack in the middle of the Fed’s full employment estimates that were released only two months ago. Wage growth also improved in August, rising 0.3% for the month compared to a 0.2% gain during the prior month. On balance the jobs report had more positives than negatives.

There is now nothing in the labor market that should prevent the Fed from raising rates at its September meeting, unless of course, they decide to move the goal posts on us again.

In terms of measured inflation, the Fed may be able to get away with further delay of a rate hike as plunging oil prices and a strengthening dollar have temporarily pushed the headline unemployment number under 1%. But low inflation readings won’t be sustained for long. If you look through the headline number to more stable sources of inflation such as services inflation or the Cleveland Fed’s trimmed mean CPI, measured inflation is steady as she goes.

So then, the jobs market looks good and inflation is steady. According to the congressional mandate that the Fed had hid behind for years now, there is no reason to delay.

Financial market volatility is the only wild card now. Volatility as picked up just as the Fed signaled a willingness to hike rates. Will Yellen change the course from Bernanke who was as slave to the markets or will she follow her predecessor and obey Wall Street’s every command? The odds say Yellen & Co., back down on a rate hike. September 17, is D-day. Stay tuned.