The index-based ETF investment craze continues to lead to distortion in financial markets. Many investors are buying funds without fully understanding the risks.

The risk of large-cap equity indices has increased over recent years as a handful of the market’s most expensive shares have become such a large portion of the index. The risk of bond index ETFs has also increased.

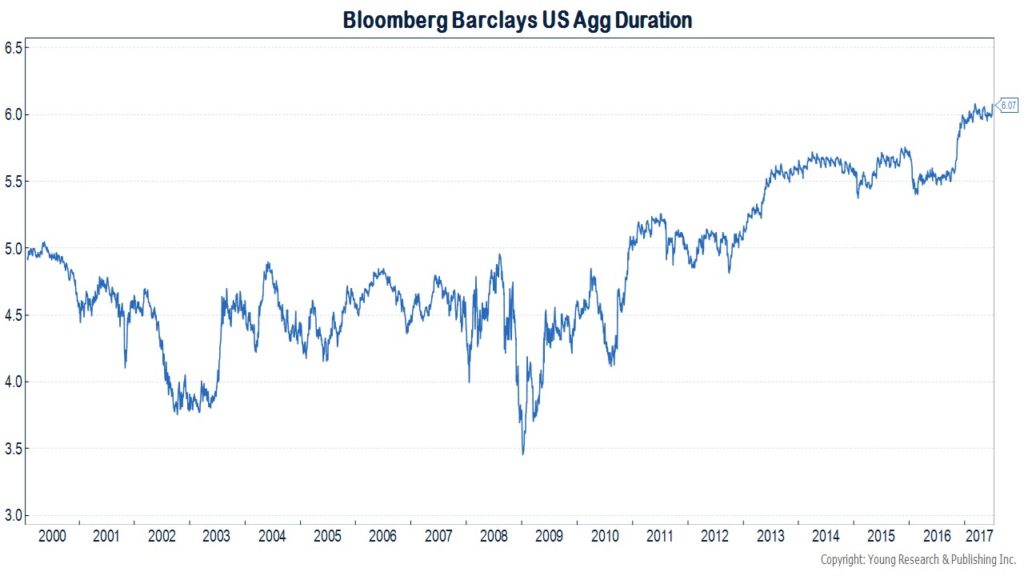

The chart below shows that the duration of the Bloomberg Barclay’s U.S. Aggregate Index has increased 20% over the last five years and 35% since 2009. Duration is a measure of interest rate risk. The higher the duration of a bond portfolio, the bigger the price drop for a given change in interest rates.

If you are still indexing the bond component of your portfolio via ETFs or mutual funds, it may be time to take a more tailored approach.