What is the Outlook for the Vanguard GNMA Fund in 2020? GNMA bond prices like all bond prices are influenced by the level of interest rates and the outlook for interest rates.

GNMA bonds are bonds that are backed by mortgages, so their prices tend to be influenced more by the level of long-term interest rates than by short-term interest rates, but both matter.

The Federal Reserve has absolute control over short-term interest rates, but their policies heavily influence the level of long-term interest rates.

What Does Interest Rate Policy Mean for Vanguard GNMA?

After holding interest rates near zero and buying trillions worth of Treasury and mortgage bonds for almost an entire decade, the Federal Reserve started to move from ultra-loose monetary policy to what we would describe as a still accommodative policy in late 2015.

The tightening cycle moved at a glacial pace, but for retired and soon-to-be-retired investors, it was a move in the right direction after years of interest rate famine.

Unfortunately, the Fed tightening lasted only three years. In early 2019, after bringing short-term interest rates up to a mere 2.50%, the Fed reversed course to stave off a stock market correction. Interest rate hikes were halted in January 2019 and then cut three times over the course of 2019.

GNMA Performance During Fed Tightening

During the period of tightening November 2015-2018, the 10-year Treasury rate (the critical rate for GNMA bonds) increased from about 2% to 3%. The Vanguard GNMA fund returned an annualized .98% over this period.

Since November of 2018, 10-year Treasury rates have fallen 1.25 percentage points, resulting in a 7.70% return for the Vanguard GNMA fund.

With long-term interest rates now back near historic lows, what is the outlook for GNMA bonds?

Outlook for GNMA Bonds

In order to get a good handle on the outlook for GNMA securities, it is important to understand the factors that drive their returns.

GNMA securities are mortgage-backed securities. Mortgage-backed securities are bonds backed by payments on mortgage loans. The loans are pooled, and then out of those pools, securities are issued that entitle holders to a share of interest and principal. GNMA’s are the only mortgage-backed securities that are explicitly backed by the full faith and credit pledge of the United States government.

GNMA Securities vs. Conventional Bonds

Mortgage-backed securities are not like conventional bonds. Conventional bonds pay interest during the life of the bond and all principal at maturity. Mortgages pay principal and interest every month in varying amounts. Most investors intuitively understand this. When you take out a mortgage, you make a payment each month that includes interest and principal. When you refinance your mortgage, you are making what is called a prepayment.

Prepayment Risk

Because GNMA securities are backed by the U.S. government, they are free of credit risk, but they do carry prepayment risk and extension risk. Prepayment risk is the risk that your principal will be repaid before maturity. Why is getting paid early a risk?

Let’s say you invest in a GNMA security and every mortgage backing that security has a 6% rate. Fast-forward one year and assume that mortgage rates have fallen to 4%. Further, assume that every mortgage backing the GNMA security is refinanced to lock in that lower 4% rate. As the investor in this GNMA security, the entire balance of your principal is returned to you. You can reinvest in another GNMA security, but the prevailing rate on GNMA securities is now only 4%. Instead of earning 6% on your money, you now earn only 4%.

Extension Risk

Extension risk is the opposite of prepayment risk. When interest rates rise, the rate of prepayments on GNMA securities slows, which effectively extends the maturity of a GNMA security. You now have a longer maturity bond than you originally invested in just as interest rates are rising. The combination of higher rates and longer maturity results in a lower price.

While interest rates are the big factor determining the percentage of a pool of mortgage-backed securities paid back ahead of maturity, it is not the only factor. The rate of prepayments on a pool of mortgages also depends on the historical path of interest rates, housing turnover, the aging of loans, seasonality, and credit conditions among other factors.

In return for taking on prepayment risk and extension risk, investors in GNMA securities are compensated with yields greater than the yields on Treasury securities. How much greater varies over time and by measurement.

The Factors that Influence Risk

Some of the major factors that influence prepayment risk and extension risk include the level of interest rates, the historical path of interest rates, housing turnover, the aging of loans, seasonality, and consumer credit conditions.

With the Fed cutting interest rates late in the business cycle and signaling they plan to pause on interest rate cuts, for the time being, GNMA investors should be thinking about both extension risk and prepayment risk.

If the Fed’s interest rate cuts in 2019 end up being more of a mid-cycle adjustment than the start of a bona fide easing cycle that coincides with an economic downturn, long-term interest rates are likely to rise and GNMA bonds will suffer.

However, if the Fed resumes cutting rates because the economy slows, homeowner refinancing is likely to pick up, which could result in lower than hoped for realized returns for GNMA bonds.

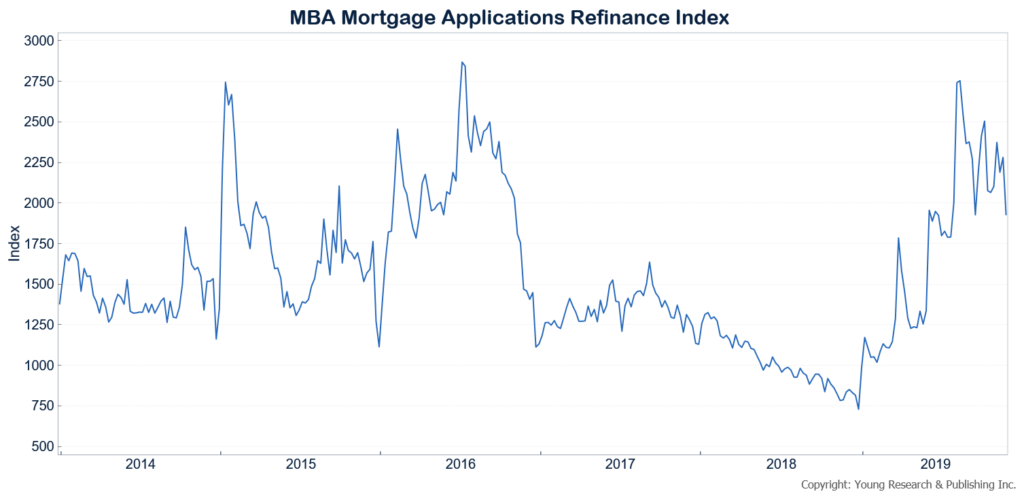

The chart below shows refinancing activity surged in 2019 as long-term interest rates fell. When re-fis surge, the indicated yield on the Vanguard GNMA fund often isn’t realized as higher-yielding bonds in the fund are redeemed early and replaced with lower-yielding bonds.

The Bottom Line on Vanguard GNMA

The low level of long-term interest rates means that extension risk in GNMA securities is once again at the forefront, but prepayment risk is also a worry if the economy weakens. That doesn’t mean Vanguard GNMA isn’t a good investment.

The question investors must answer is, am I being fairly compensated for that risk? At a current yield of 2.42% on the Vanguard GNMA Fund, there is an indicated yield premium of about 0.80% versus comparable maturity Treasury funds, but the risk that the indicated yield on GNMA bonds will not be realized is significant.

For a relatively low-risk option, you could do a lot worse than Vanguard GNMA today. We would point out though that if you are buying bonds as part of a diversified portfolio that includes stocks; Treasury bonds and corporate bonds may offer better counterbalancing properties than GNMA bonds.

We update GNMA bond yields monthly.