As you know from here, knowing when and how much to tip is serious business in Paris. If it were up to Your Survival Guy (it’s not), I would do away with tipping altogether both there and here. Just tell me how much I owe. But if we’re going to stick with tips, it shouldn’t have to be like high school Algebra to figure it out. You’re out to lunch or dinner. This is supposed to be fun, right? Expect this to get much more complicated. There are a number of proposals going around Washington, D.C., at the moment to eliminate taxes on tip income, but, explains Alex Muresianu at The Tax Foundation, there could be unintended consequences of ending taxes on tips. He writes:

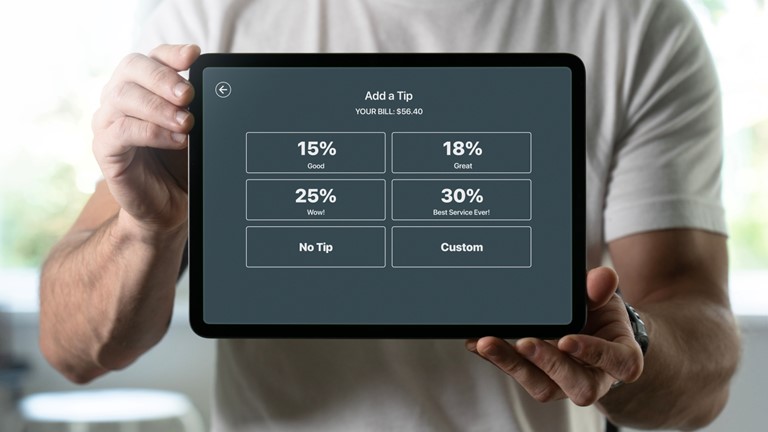

By making one type of income (tips) exempt from income tax, while other types of income (most importantly, wages) remain taxable, the proposal would make more employees and businesses interested in moving from full wages to a tip-based payment approach. That would mean more service industries adopting the restaurant industry approach of a list price up front and an expected voluntary tip at the end of the transaction.

This kind of behavioral response makes it difficult to estimate the cost of the no-tax-on-tips proposal. A simple analysis of tipped income suggests a lower bound cost of around $107 billion over 10 years for an income tax exemption only, assuming tips as a share of total wage income remains as it was in 2018 and applying the marginal tax rate on wages faced by taxpayers making between $30,000 and $40,000 (waiters and waitresses earn a median wage of about $32,000 and a mean wage of $36,500).

Small behavioral effects, such as higher tips in existing tipped occupations, would incrementally raise that cost. More substantial behavioral responses, such as previously untipped occupations introducing tipping, could make the policy dramatically more expensive.

One could imagine a scenario in which, say, highly compensated lawyers or accountants begin to receive some of their income as voluntary tips. Lawmakers could design the exemption to prevent or minimize exploitation, such as restricting the tax exemption to taxpayers below a certain income threshold or only to tipped income received in traditionally tipped occupations. Additionally, for tip income to be tip income, the payment must be made voluntarily by the customer and cannot be previously agreed upon (among other restrictions), so arrangements to agree upon a “tip” before providing, say, legal services would be illegal, but that could prove challenging for the IRS to enforce. Additionally, lawmakers could reduce the incentive to recharacterize income by placing a cap on the amount of tip income that could be exempted.

The existing no-tax-on-tips bills do not offer much in terms of safeguards to prevent potential abuse. But even with safeguards, the policy would be poorly targeted at low- and middle-income earners, given the relatively small share of the population working in tipped occupations. Worse, the exemption itself, and any safeguards added, would add to the complexity of the tax code overall.

Action Line: Cutting taxes on tips is well-intentioned, but maybe it’s better to just cut taxes altogether. Then, you won’t be faced with requests for tips at the doctor’s or accountant’s offices. If you’re as frustrated with tips as I am, let me know here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.