You have learned a lot from me about the dangers of heading up the mountain without a solid plan, and a refusal to turn around even when it’s obviously too dangerous to climb. The Lions of Winter by Ty Gagne isn’t just a warning to mountain climbers or backcountry skiers, it’s a warning to anyone attempting something dangerous without a backup plan.

A danger many Americans take on without giving so much as a thought to the risks involved is taking on mountains of debt. Credit card debt, student loans, auto loans, mortgages, financed furniture, second mortgages, and home equity loans, and the list goes on. People bury themselves deep in debt, sometimes with no real plan to escape. Take a look at my chart of American credit card balances below. The total is nearing $1 trillion after rocketing upward through the Covid recovery and high inflation of the Biden era.

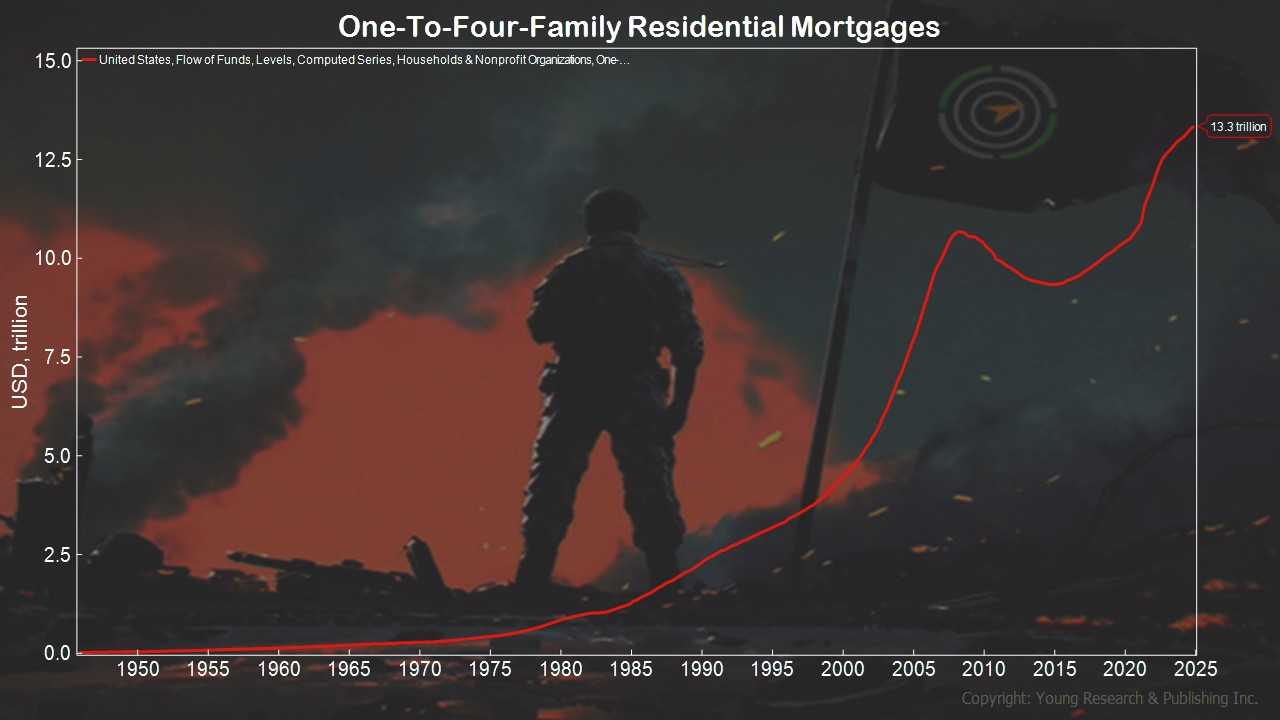

Mortgages aren’t any better. Outstanding liabilities for one-to-four family residential mortgages have grown to $13.3 trillion, also a record high.

Mortgages aren’t any better. Outstanding liabilities for one-to-four family residential mortgages have grown to $13.3 trillion, also a record high.

Now, debt can be outgrown. As the economy grows, debt tends to grow, but it shouldn’t be ignored either. Like a storm on the mountainside, you shouldn’t climb into it; you should find a way around it or head back to basecamp and try again when the weather is better.

Action Line: Don’t climb a mountain of debt. Your Survival Guy likes you to be debt free when possible. Debt has its uses, but be sure you have an escape plan that makes sense. When you want to talk about your escape plan, email me at ejsmith@yoursurvivalguy.com. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.