A new report from the National Institute on Retirement Security shows that around 66% of working age Millennials have nothing saved for retirement. That’s not good, but also not terribly surprising since so many of them have had a delayed start in the work force, have massive student loans, and rents are at some of the highest levels ever.

On CNNMoney, Katie Lobosco details the report, writing:

About one-third are saving for retirement. Most have less than $20,000 but some have much more. The average account balance is $67,891, according to the report.

If they are saving, it’s likely their employer offers a retirement plan, like a 401(k). More than 94% of Millennials who are eligible for a workplace retirement plan are saving. That’s about the same participation rate as older generations.

But Millennial workers in particular often find they don’t meet the eligibility requirements for a 401(k) even if their employer offers one. Sometimes they don’t work enough hours, or employers require them to work for a certain amount of time before they qualify.

About 25% of Millennials said they were not eligible to participate in an employer-sponsored retirement plan because of their part-time status.

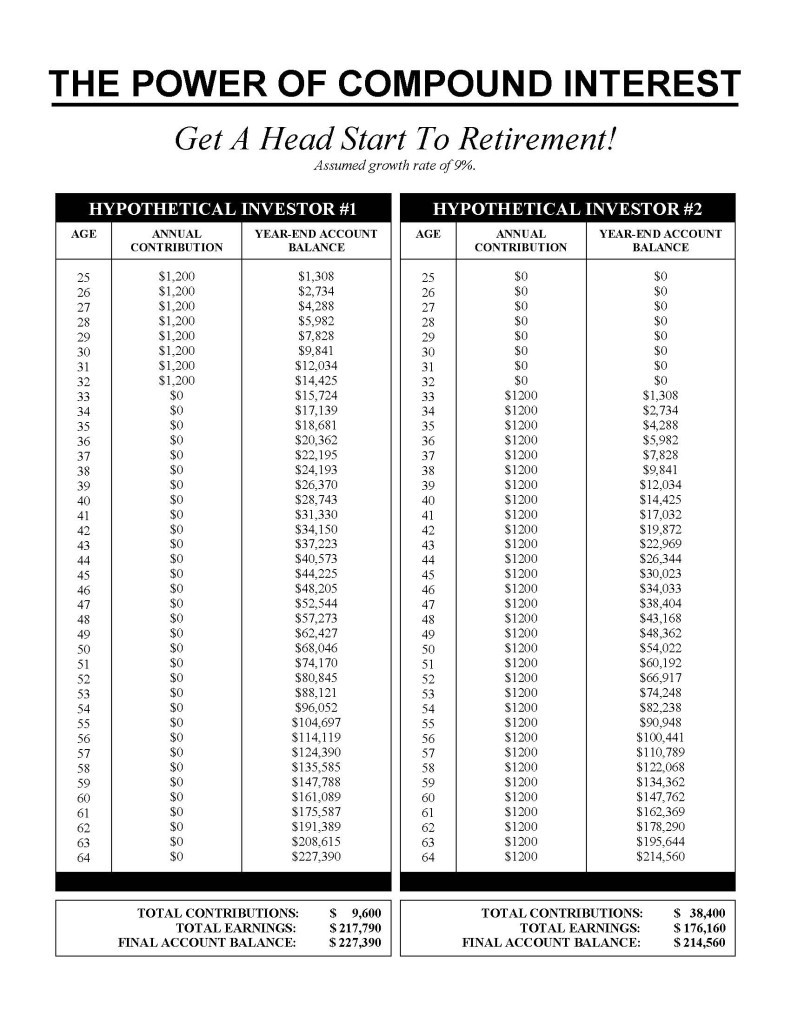

It’s never too early to start saving. With the power of compounding, even saving a little today could make a major impact on your wealth headed into retirement. If you are a young person, save whatever you can. Invest it as best you can, and compound it until you retire. Take a look here at what the power of compound interest can do. A saver who saves a little bit early, can end up with even more than someone who saves more but gets a later start.

Originally posted on Yoursurvivalguy.com.