Let’s stay on the subject of making sure you get paid in times of trouble no matter what, just like Tony Soprano. Because any time you invest, you’re using your own money to create interest, dividends, or rent, and preferably all three. I’m not interested in price increases and selling assets. I want you to think like an owner of a multitude of assets.

I remember my dad telling me how, as a teenager, he would collect for his dad’s rental properties. Some of them were in rougher neighborhoods, and his dad would tell him: “You stand to the side of the door when you knock. You never know what’s coming through it.” Lesson learned.

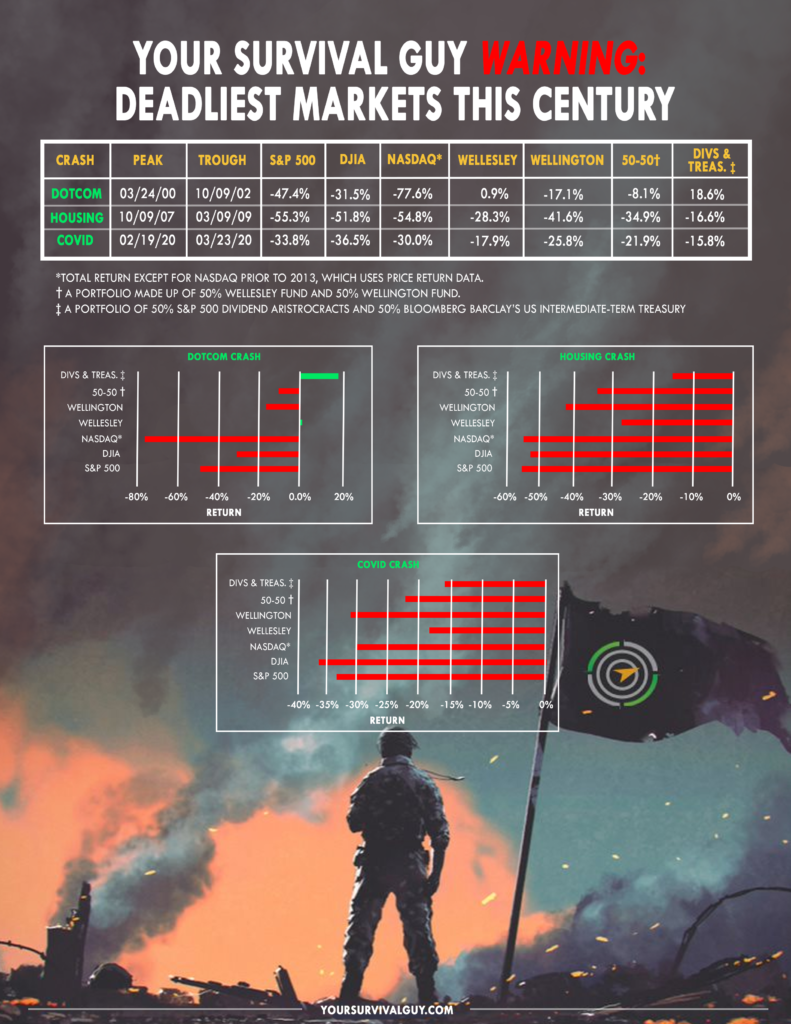

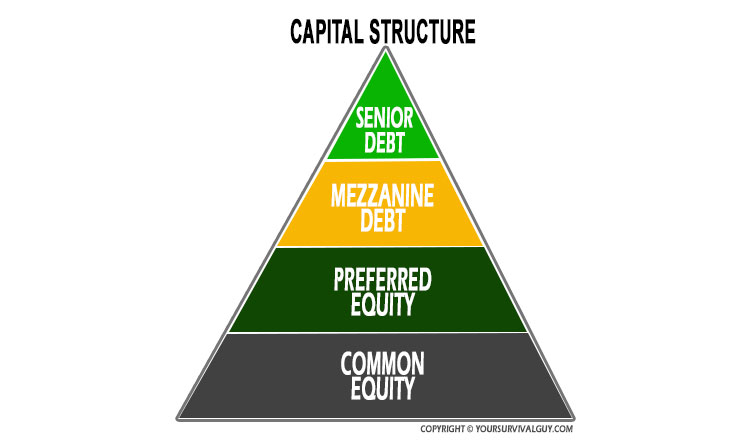

In times like these, not all rents are paid on time. But if you own the building, you own the building, and the rents it produces are yours by law. The same is true with bonds. You own the bond and have a legal right to the income. As a bondholder, that places you above stockholders in the capital structure. Remember, in times of trouble, it’s the return of assets, not the return on assets, that matters most.

Action Line: Read this from Michael Milken, who knows about capital structure. He wrote this at the end of the financial crisis “Why Capital Structure Matters: Companies that repurchased stock two years ago are in a world of hurt,” for The Wall Street Journal on April 21, 2009. Let me help you stay on track by signing up for my free monthly Survive & Thrive letter, but only if you’re serious.

The current recession started in real estate, just as in 1974. Back then, many real-estate investment trusts lost as much as 90% of their value in less than a year because they were too highly leveraged and too dependent on commercial paper at a time when interest rates were doubling. This time around it was a combination of excessive leverage in real-estate-related financial instruments, a serious lowering of underwriting standards, and ratings that bore little relationship to reality. The experience of both periods highlights two fallacies that seem to recur in 20-year cycles: that any loan to real estate is a good loan, and that property values always rise. Fact: Over the past 120 years, home prices have declined about 40% of the time.

History isn’t a sine wave of endlessly repeated patterns. It’s more like a helix that brings similar events around in a different orbit. But what we see today does echo the 1970s, as companies use the capital markets to push out debt maturities and pay off loans. That gives them breathing room and provides hope that history will repeat itself in a strong economic recovery.

It doesn’t matter whether a company is big or small. Capital structure matters. It always has and always will.

Mr. Milken is chairman of the Milken Institute.

Originally posted on Your Survival Guy.