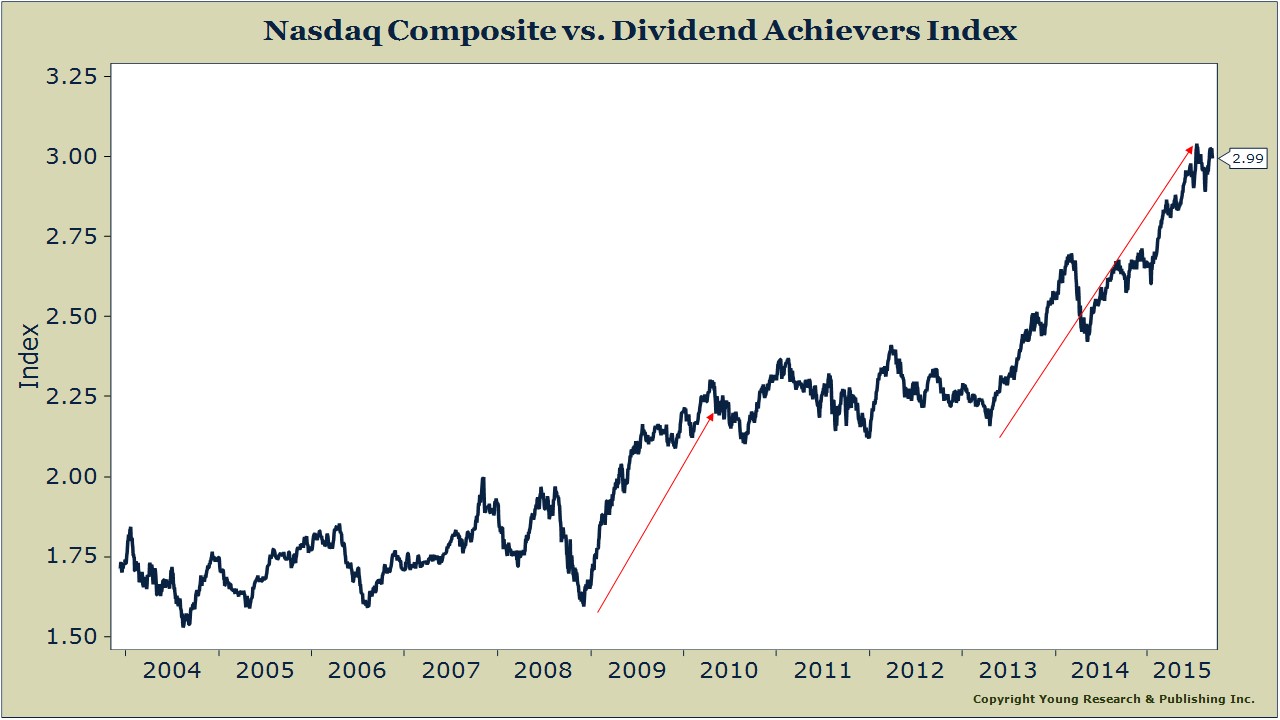

Despite the correction in stock prices over the summer and the general choppiness in the market since, the more speculative oriented NASDAQ continues to outrun more investor friendly shares. We represent the investor-friendly market here by the dividend achievers index (companies with a record of paying and increasing dividends).

The market is saying that a bird in the hand is no longer worth two in the bush. Investors are instead putting a premium on the prospect of there being two birds in the bush a decade or more in the future. Is that a strategy you want to partake in?

Then we agree. To remain on the straight and narrow in this speculative market ignore the broader market indices. Is it really prudent to try to keep pace with an index that is being led by bio-tech stocks and internet companies that could be put out of business by a 20 year old college dropout?