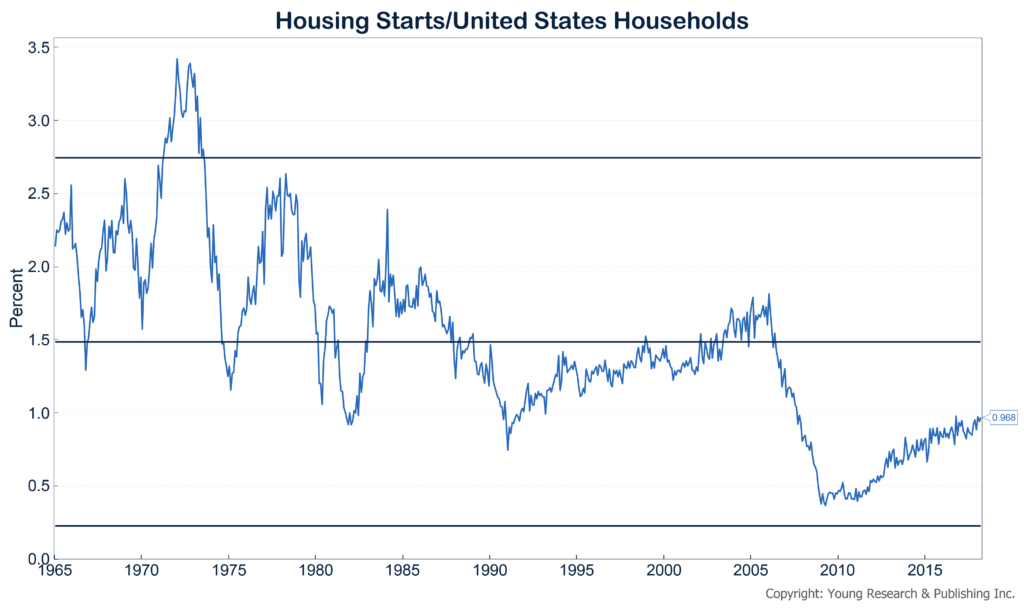

In a surprise to many economists, housing starts rose 5% in the month of May. Despite rising housing starts, the housing market is still sluggish when starts are viewed as a percent of U.S. households. By that measure, current start rates are barely above the lows of the 1991 housing collapse.

Sharon Nunn reports in The Wall Street Journal:

Housing starts rose 5% in May from the prior month to a seasonally adjusted annual rate of 1.35 million, the Commerce Department said Tuesday. Compared with a year earlier, starts were up 20.3%.

The strong improvement was spread fairly evenly between single-family and multifamily, despite expectations that builders would pull back on new apartment construction given a flood of new units already hitting the market. Single-family construction increased 3.9% in May compared with a month earlier, while multifamily building increased 11.3%, according to the Commerce Department.

Midwestern builders also significantly ramped up construction, good news for a region that had lagged compared with the South and the West through much of the economic recovery. Housing starts in the Midwest increased 62.2% in May compared with a month earlier—albeit with a 28.1 percentage point margin of error.

Read more here.