“Survival Guy, I’m one of the most conservative investors you’ll ever meet,” said Dick Young. “I don’t look to the markets to make me rich. I already am. I look for what it’s offering right now, today, not tomorrow. What is it going to pay me today in the way of interest?”

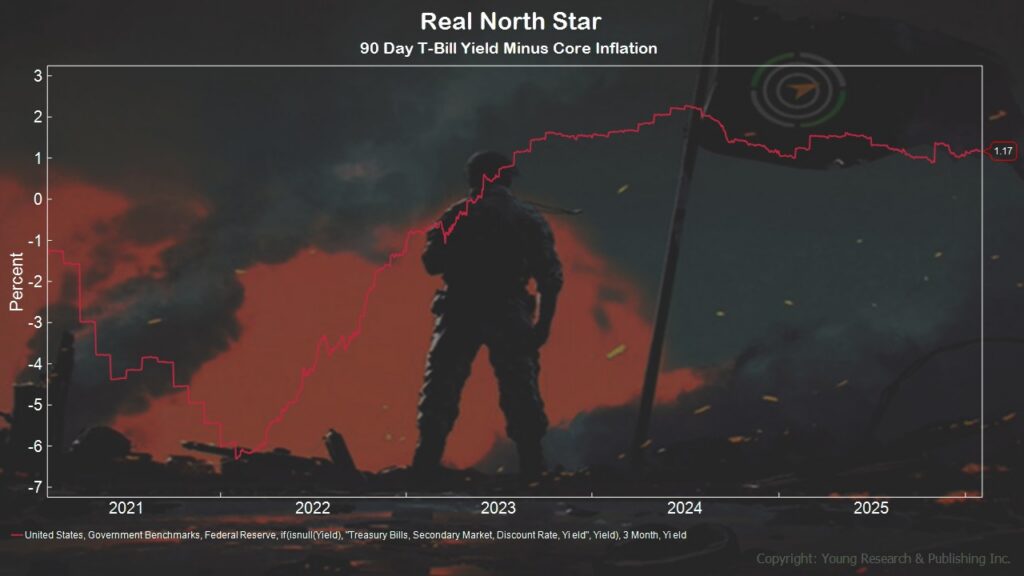

“Run your finger along my chart of my North Star,” he continued, “and you quickly get a sense of gravity. Investors hoping for much more than the risk-free rate had better be ready for the consequences of taking on more risk. It’s that simple.” Click.

This message from Dick was from last week. It may have been from 30 years ago when I first met him. Because of the many things I’ve learned from him, one guiding characteristic is that the man is consistent. His message never wavers. Times change. His message does not.

Investors have a short-term memory. They forget the endeavor of investing is about life or death—of money. And whoever said money isn’t everything never had much of it.

Investing is like gravity. It is a tough teacher. It will always teach you lessons. It’s up to you to choose which school to attend: the one of hard knocks or the one of slow and steady wealth. One of them is for the wiseman. Choose carefully.

Action Line: When you’re ready to talk, let’s talk. Email me at ejsmith@yoursurvivalguy.com.

Read the entire series here.

Originally posted on Your Survival Guy.