As elections come up, where we live and the political/governance climate there comes into sharper view. This piece I wrote on August 10, 2017 examines the tax climates of the states, and how retirees should make that a factor in their plans.

Guess who needs the most of your dollars to survive? You guessed it, Washington D.C.

If you’re a retiree who has been living and working in Washington D.C. for your entire career, you would without a doubt stretch your dollars further if you moved to a less expensive locale. Washington D.C. is the most expensive place to live in the continental United States.

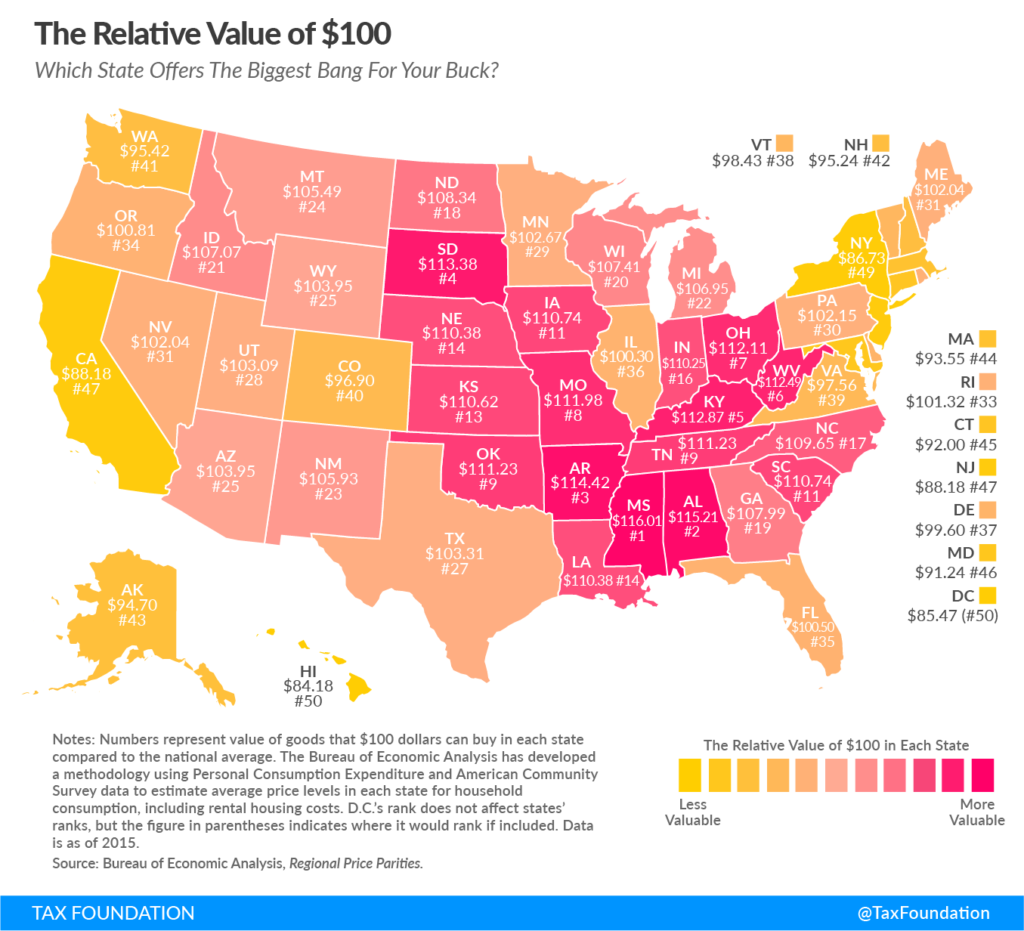

As the Tax Foundation map below makes clear, for $100 of spending in Washington D.C., a consumer only receives about $85.47 worth of goods when compared to the national average.

How does a 15% haircut on all your purchases sound on a fixed income in retirement?

Instead of taking a beating on each purchase, retirees can look for low tax, low cost states where their money will stretch the furthest. Check out the map below for more.

Amir El-Sibaie writes for the Tax Foundation:

This map shows the real value of $100 in each state. Prices for the same goods are often much cheaper in states like Missouri or Ohio than they are in states like New York or California. As a result, the same amount of cash can buy you comparatively more in a low-price state than in a high-price state.

The Bureau of Economic Analysis has been measuring this phenomenon for two years now; it recently published its data for prices in 2015. Using this data, we have adjusted the value of $100 to show how much it buys you in each state.

For example, Ohio is a low-price state. There, $100 will buy you goods that would cost $112.11 in a state at the national average price level. You could think of this as meaning that Ohioans are, for the purposes of day-to-day living, 12 percent richer than their incomes suggest.

The states where $100 is worth the most are Mississippi ($116.01), Alabama ($115.21), Arkansas ($114.42), South Dakota ($113.38), and Kentucky ($112.87). In contrast, $100 is effectively worth the least in Hawaii ($84.18), the District of Columbia ($85.47), New York ($86.73), New Jersey ($88.18), and California ($88.18). See the table at the bottom of this post for a ranking of all 50 states.

Regional price differences are strikingly large; real purchasing power is 36 percent greater in Mississippi than it is in the District of Columbia. In other words, by this measure, if you have $50,000 in after-tax income in Mississippi, you would need after-tax earnings of $68,000 in the District of Columbia just to afford the same overall standard of living.

Read more here.