Saudi Aramco CEO Amin Nasser has sounded the alarm on a looming global oil shortage, warning that over a decade of underinvestment in exploration combined with growing demand could leave the world short of supply, according to Malcolm Moore of the Financial Times. He cautioned that the US shale boom, which accounted for much of recent growth, is expected to plateau, making it unclear where future barrels will come from. Despite current oversupply and projections of prices dipping below $60 per barrel, Nasser urged the industry to reverse the trend of slashed investment in complex upstream projects. Analysts now warn of a potential shortfall of up to 10 million barrels per day by 2040 if new capacity is not added. Moore writes:

Saudi Aramco CEO Amin Nasser has sounded the alarm on a looming global oil shortage, warning that over a decade of underinvestment in exploration combined with growing demand could leave the world short of supply, according to Malcolm Moore of the Financial Times. He cautioned that the US shale boom, which accounted for much of recent growth, is expected to plateau, making it unclear where future barrels will come from. Despite current oversupply and projections of prices dipping below $60 per barrel, Nasser urged the industry to reverse the trend of slashed investment in complex upstream projects. Analysts now warn of a potential shortfall of up to 10 million barrels per day by 2040 if new capacity is not added. Moore writes:

The head of Saudi Aramco has warned of a global oil shortage on the horizon, after a decade in which the energy industry turned its back on the search for new oil.

Amin Nasser, chief executive of the world’s largest oil company by production, called for a return to spending on exploration and production as global demand for oil continued to grow, saying current investment was “extremely low”.

“We had a decade . . . where people didn’t explore. It’s going to have an impact,” Nasser told the Financial Times. “If it doesn’t happen, there will be a supply crunch.” […]

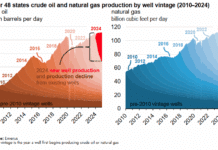

“Eighty to 90 per cent of growth came from shale,” he said. “If you look at the next 15 years, shale is most likely to plateau and decline. Where are you going to bring the additional barrels to meet the demand?” […]

Rather than spending heavily on complex and difficult projects, the industry has instead focused on drilling lower-cost reservoirs in a bid to meet demand. […]

“When you have the best discovery that has been made in the past couple of decades producing only enough to cover one-third of the demand in one year, that’s a big issue.”

Read more here.