UPDATE November 30, 2021: Since we first posted this in March, stocks have continued their upward climb rising another 18%. Investors who bailed out at the March 2020 bottom and still haven’t gotten the courage to invest back in the market have forgone a 113% return. Ouch! And that doesn’t even count the capital gains taxes that were likely due when long-held positions were sold. Trying to rush for the exits when everyone else in the building is doing the same and then piling back in when the all-clear signal is given is a good way to get banged up. A long-term balanced approach that properly calibrates the risk you are willing and able to take is the surer path to investment success.

Originally posted on March 30, 2021.

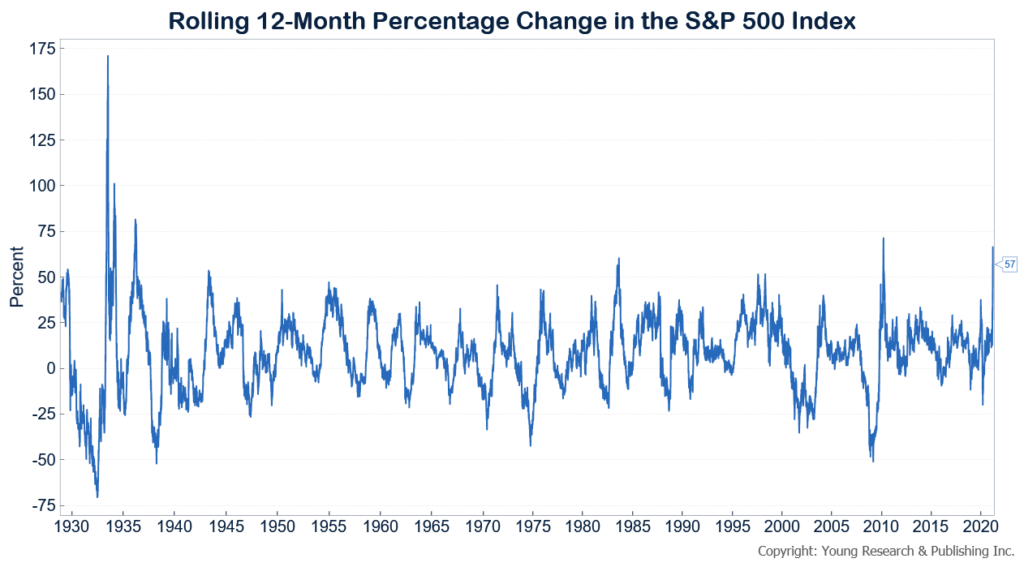

U.S. stocks just completed their largest 12-month rally since 1936 (see the chart below). The S&P 500 gained 74.9% from March 23, 2020, through March 23, 2021.

Investors who bailed out of the market in March or April of last year because of the unprecedented size and scope of the pandemic created too much uncertainty, are surely soaked with regret today.

Stocks are volatile. Savvy investors recognize that going in. Maintaining proper balance and perspective is vital to successfully riding through bear markets as well as bull markets.

The Financial Times has more on the historic rally:

Last March was a good time to be a contrarian investor. As the coronavirus pandemic swept into the west and equity and bond markets went into heady tailspins, those who held their nerve and bought into US stocks without selling out later are now sitting on historic gains.

The S&P 500, the broad US equity benchmark that holds the nation’s largest publicly traded companies, rose 74.9 per cent between March 23 last year and the same date in 2021. That, according to strategists at Deutsche Bank, was the index’s most vigorous rise over any 12-month period since 1936.

The gains were kickstarted by a March 23 meeting of the US Federal Reserve, where its policymakers moved to soothe the ructions in financial markets by pledging to buy an unlimited amount of Treasuries and purchase companies’ bonds for the first time in the central bank’s history.